The Tala Loan App is not a new name in online lending in Kenya. Tala started in Kenya in 2014 as “Mkopo Rahisi,” and since then, many Kenyans have been drawn to using the app. What makes the Tala loan app stand out is that it doesn’t check with CRBs, and it’s one of the loan apps in Kenya with the fastest disbursement rates. The lender gives loans from Ksh 1000 to as high as Ksh 50,000.

The thing with Tala is that if you are going to borrow from them, you must make a commitment to pay your loan on time. Late Payments may attract penalties, and in some cases, you can be denied any future loans. Do you know how to repay Tala loans in Kenya? Well, this is possible using the Tala Paybill number. Everything you need to know is covered in the Guide.

Repaying Your Tala Loan via M-Pesa

Tala loan applications in Kenya are made through its official mobile app on the Google Play Store. Through the same app, you can also see the amount you owe Tala and initiate the payment process. However, take note that the repayment process is done on M-Pesa

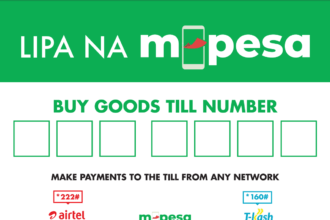

For those who don’t know, Tala has a Paybill number 851900, which makes it easier to repay what you owe. Here is how you can easily pay back your loans:

- Open the M-Pesa menu on your phone

- Choose the “Lipa na M-Pesa” option, then select “Pay Bill.”

- Enter Tala’s Paybill number, which is 851900

- In the “Account Number” section, enter the phone number you used to register with Tala

- Enter the loan amount you want to repay and input your M-Pesa PIN to authorise the transaction

- Confirm both the amount and the recipient

- You’ll receive an SMS from Tala confirming that you have repaid your loan

Benefits Of Paying Tala Loans on Time

For those using the Tala loan app, it is no secret that Tala has loan limits, which are most influenced by several factors. If it’s your first time using Tala, you will be given loans between Ksh 1,000 and 2,000. It’s here that the concept of Tala loan limits comes into play.

So, one of the benefits of making early payments is that it gives you the power to increase your next loan limits. The more you borrow and pay back your loans, the higher your loan limit will be the next time you borrow

By the way, increasing your Tala loan limit is not only tied to making your repayments. Remember, Tala does not check to access your creditworthiness. Instead, they use in-house app algorithms that access a number of factors, including your phone data, to give you a loan.

So, ensure that you continue using the Tala loan app frequently, do not become indebted to another lender, and continue using all M-Pesa services.

What Happens If You Fail to Repay Your Tala Loan

When it comes to loan repayments, Tala has flexible loan repayment modes. This means you can choose to pay back your loan on time up to a maximum period of 2 months. After this, they only allow a grace period of up to 7 days before late fees are charged.

If you fail to repay your Loan, Tala completely will permanently blacklist you from the app and forward your name with an ID number to credit reference bureaus in Kenya.

Tala Contacts

You can contact Tala customer care in Kenya via :

- Email address: [email protected]

- X (Formerly Twitter): @TalaKenya

- Facebook page: Tala

And there you have it. Repaying Tala Loans is essential for applying for another loan and getting a higher loan Limit. Tala only allows you to repay your loan using its official pay bill number, 851900. I have taken you through the steps to follow in this guide, and I hope you found them helpful. If you need my assistance, please let me know in the comment section below.