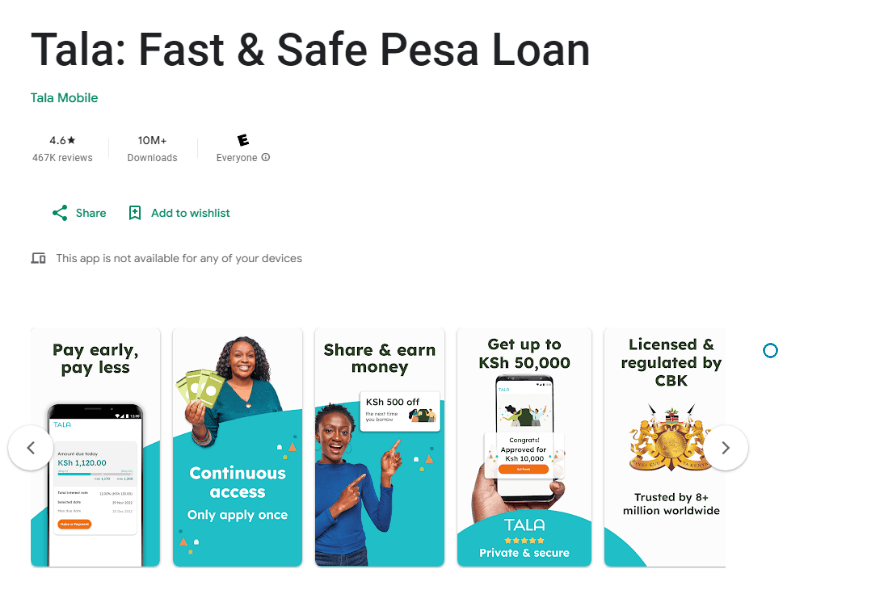

Kenya has many loan apps, but not all are licensed by the Central Bank of Kenya. Therefore, we advocate using loan apps as a last option when you truly need cash. Still, choosing licensed lenders is an option that you should truly consider. Tala is an app that has been around for a very long time, attracting over 10 million downloads on the Google Play Store. This app offers loans for various amounts, and any Kenyan is eligible to apply so long as they meet the requirements in place.

What makes the Tala App unique is that it offers loans even to those marginalised by traditional lending finance institutions such as Banks. In short, Tala offers loans without CRB checks. If you are just getting started, don’t worry; this comprehensive guide will walk you through the Tala Loan App.

What is Tala?

Tala is a Popular fintech Platform headquartered in Santa Monica, California, United States. It was founded in 2011 by Shivani Siroya, and later, in 2014, it entered Kenya as Mkopo Rahisi. It operates in Kenya, Mexico, the Philippines, and India.

In Kenya, Tala offers an unsecured loan type as it does not require one to provide a guarantor. For this reason, many people have resorted to using the app more often as compared to borrowing from Banks, Chamas, and even SACCOS, which may require financial security in Kenya

Also, to get started with Tala, you need to download its app, Register, and apply for a loan. If you are qualified, you will be given the loan instantly; if not, Tala will advise you on how to qualify for your next application.

Tala Loan Limits and Interest Rates

What is Tala’s first loan limit? If you are a first-time applicant for the Tala Loan, the loan amount you can be awarded ranges between Ksh 1,000 and Ksh. 2,000.

As you continue to use Tala and repay your loans on time, your loan limit can gradually increase. As of 2024, Tala’s maximum loan limit is Ksh. 50,000.

Tala loans are not interest-free; they attract a service fee, which is the interest rate, ranging from 0.5% to 30.50% based on the loan amount and repayment period.

Additionally, they charge a daily interest rate of 0.3% to 0.6% and a 20% excise tax on the daily interest calculated.

How To Download the Tala Loan App

The California-based lender in Kenya offers Loans through its Mobile App. It is essential to clarify that Tala does not have a USSD code for loan applications in Kenya. The only way to get a loan is through its official mobile app (currently available only for Android devices).

To have the app on your device, follow the steps below :

- Visit the official Tala website at https://tala.co.ke/

- On the website’s homepage, click ” Get it on Play.” You will be redirected to a new window to download and install the app on your device.

After downloading and installing the app, make sure that you register using your M-Pesa number to log in and apply for a loan.

How to get your first Tala loan on your phone

Once you’ve registered, you can apply for your first Tala loan quickly, but first, make sure that you have the following:

- An Android phone that can access the internet

- A registered Safaricom M-Pesa number that has been operational for more than 7 Months

- Registered on the Tala Platform

To apply for a loan, you need to complete the Tala loan application form. During this stage, make sure to provide accurate answers, as this is one factor determining your loan amount.

Next, enter your loan amount and choose your repayment period. If you have done everything right, proceed, click on Submit, and wait for your loan request to be approved.

If everything is okay, you should receive an SMS message on your line confirming whether your loan has gone through. If it is successful, you will receive the loan in your M-Pesa wallet within minutes.

How to repay a Tala loan using M-Pesa

You will need to repay your first Tala loan to apply for your second loan. By the way, repaying your loan time increases the chances of increasing your Tala Loan Limit to KES 50,000.

Tala has a Paybill number that helps you repay your loans efficiently. Here is how:

- Open your Safaricom menu and select M-Pesa.

- In the M-Pesa menu, choose Lipa na M-Pesa.

- Select the Pay Bill option.

- Enter the business number 851900.

- Enter your Tala-registered phone number as the account number.

- Enter the payment amount.

- Enter your M-Pesa PIN.

Tala Loan Contacts

For immediate assistance, you can contact Tala using the contact information below.

- Email address: [email protected]

- X (Formerly Twitter): @TalaKenya

- Facebook page: Tala

What is the maximum loan amount I can get from Tala?

The maximum loan amount you can get from Tala is Ksh 50,000 in 2025.

How do I increase my Tala loan limit?

To increase your Tala loan limit, ensure you make early or on-time payments and actively use your M-Pesa account. However, remember that Tala considers multiple factors when determining your loan limit, so it takes time to actually grow your Loan limit up to KES 50,000

Conclusion

That’s all you need to know about the Tala Loan App in Kenya. If you want to book a loan from Tall, it all starts with downloading the app from the Play Store and registering for a loan. As a first-time applicant, your loan limit will be low, i.e., between KES 1,000 and KES 2,000, but the more you repay your loans and keep using the Tala Loan App, the more it grows to KES 50,000.