The National Social Security Fund (NSSF) is a Kenyan government agency whose main objective is to offer social protection to all Kenyan workers in the formal and informal sectors. The NSSF functions as both a pension and a provident fund, offering long-term retirement benefits and savings in certain circumstances.

NSSF was established in 1965 and currently operates under the 2013 Act. The act provides a framework for employers to register for NSSF and make contributions on behalf of their employees. Failure to do so on time can lead to substantial damages such as penalties

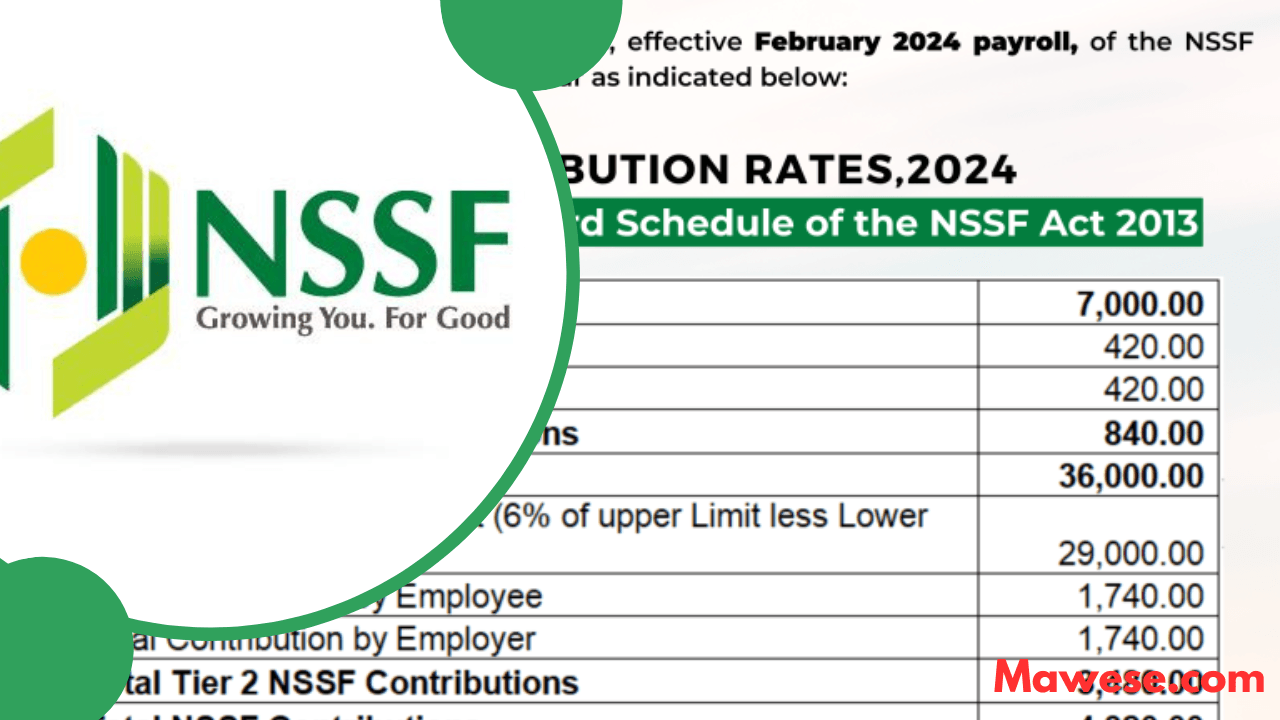

Starting February 2024, the National Social Security Fund has been revised, raising the minimum wage for contributions from KSh 6,000 to KES 7,000 in the lower limit and KES 18,000 to KES 36,000 in the upper limits. These changes are part of a gradual increase in NSSF contributions over five years, as mandated by the NSSF Act of 2013.

What are tier 1 and tier 2 NSSF rates?

The National Social Security Fund rates are based on a tiered system, which means that the amount of NSSF Contributions you make is determined mostly by the salary scale in which you fall.

NSSF has two tiers categorized as Tier 1 and Tier 2 Contributions as follows:

Tier 1 Contributions

Tier 1 applies to the first Ksh 7,000 of your monthly earnings. Both you and your employer will contribute 6% of this amount, for a total contribution of 12%. So, if you earn Ksh 10,000 per month, the Tier 1 contribution will be calculated at Ksh 7,000, and you’ll pay Ksh 420 while your employer also contributes KES 420.

Tier 2 Contributions

Tier 2 applies to earnings between Ksh 7,000 and Ksh 36,000. Again, both you and your employer contribute 6% each. This means that if you earn KES 20,000, your Tier 2 contribution will be calculated at Ksh 13,000 (Ksh 20,000 – Ksh 7,000).

Total NSSF Contributions

To understand the total contribution, let’s look at an example where you earn Ksh 36,000 per month:

- Tier 1: You and your employer each contribute Ksh 420 (6% of Ksh 7,000).

- Tier 2: You and your employer contribute Ksh 1,740 (6% of Ksh 29,000).

This totals Ksh 4,320 monthly, with you contributing Ksh 2,160, and your employer matches that amount.

How the New Rates Affect Different Salaries

The New NSSF rates will impact your Gross salary after deductions at the end of each month. The new 2024 rates, by the third schedule, do not majorly affect those earning up to Ksh 18,000. Therefore, if you fall under this category, you will just contribute the usual 6% of your earnings, with your employer also matching that amount.

However, those who feel the most pinch are those earning above Ksh 20,000 with contributions increasing from Ksh 1080 to Ksh 1200, those who earn about Ksh 36,00 will also see a double increase from the previous Ksh 1080 to Ksh 2160

Therefore, the new rates only mean one thing. The more your salaries, the more your NSSF contribution increases as illustrated in the table below:

| Salary Scale (KES) | Current Contribution (KES) | New Contribution (KES) |

|---|---|---|

| 10,000 | 600 | 600 |

| 18,000 | 1,080 | 1,080 |

| 20,000 | 1,080 | 1,200 |

| 30,000 | 1,080 | 1,800 |

| 36,000 | 1,080 | 2,160 |

| 50,000 | 1,080 | 2,160 |

| 100,000 | 1,080 | 2,160 |

NOTE: Remember that your employer will match your contribution, so the total amount for your NSSF savings is double what you see in the table.

NSSF Benefits

While the increasing contributions might seem unwelcoming to you, it’s important that the contributions you make today are for your own benefit. NSSF in Kenya serves as a pension scheme allowing you access the money you save today through contributions for you to access them once you hit the retirement age

It’s also important to remember that the NSSF provides other benefits and grants besides retirement savings. These include survivor benefits for your dependents in case of your death and invalidity benefits if you become permanently disabled. There is also the withdrawal benefit that allows you to access your funds before the retirement age; however, you will need to be at least 50 years old to apply for this benefit.

If you are also migrating to another country permanently, you can apply for the migration benefit. Lastly, there is the Invalidity benefit for NSSF members who are living with either mental or physical disabilities.