Talk of modern-day banking systems in Kenya, and one would quickly point you to using M-Pesa. Established in 2007, M-Pesa has quickly risen the ranks and has been adopted by far more than Kenyanans only but also Africa at large, with more than 66.2 Million Customers in all markets ( Statista ). M-Pesa has become a darling to many of us in the Kenyan market, including you and me. We use it to pay bills such as rent, shopping, and many more. And to make things even more enjoyable, you can actually turn the M-Pesa Money in your mobile wallet into real physical money. All this is possible through M-Pesa agents. This whole process is now what is commonly referred to as M-Pesa Withdrawal.

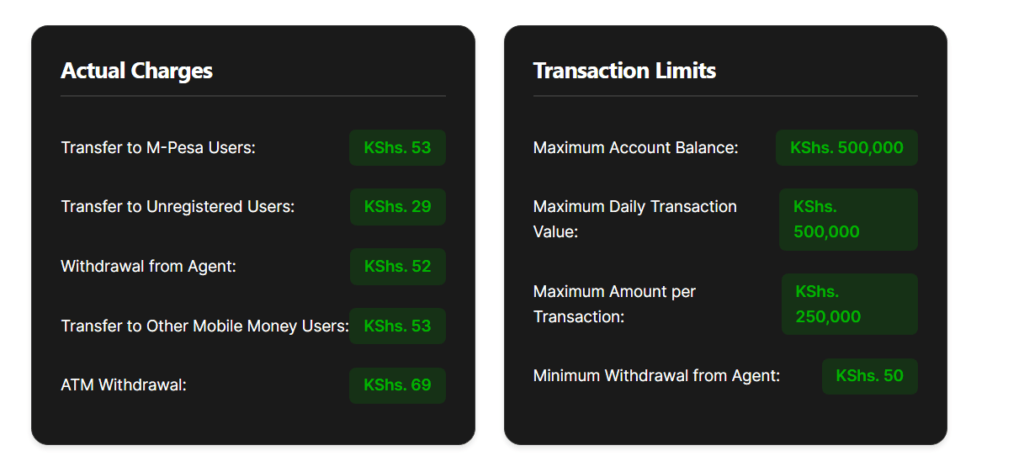

But you see, the whole process of M-Pesa Withdrawal is wholesome and enjoyable. One thing you must know is that the process actually attracts a fee on your M-Pesa balance, depending on the amount you want to withdraw. So, what are the M-Pesa Withdrawal Charges in Kenya? This comprehensive guide will walk you through the withdrawal charges for Cash at Agents and ATMs.

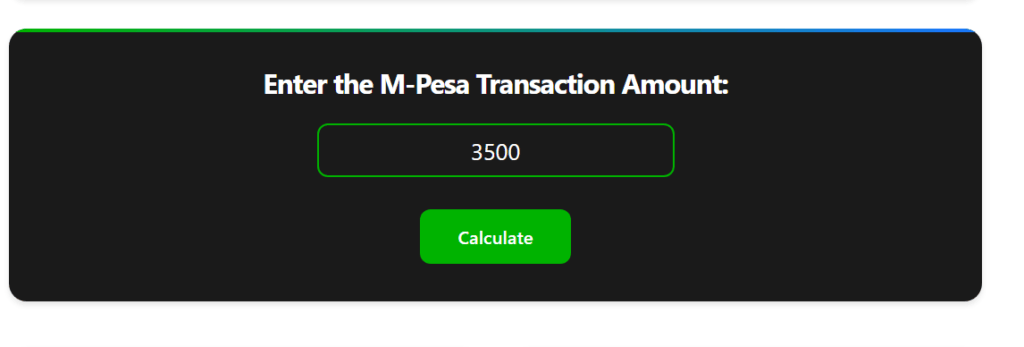

New M-Pesa Charges Calculator

Let us face it: if you want to know what the charges for M-Pesa Withdrawal are, then the objective is clear: you are looking to save money for every transaction you make. Luckily enough, we understand here at Mawese, and that’s why we have an M-Pesa charges calculator you can use. The beauty of using this online tool is that you don’t need to refer to the M-Pesa charges chart or table now and then. All you need to do is navigate to the page and enter the amount. The tool will give you all the M-Pesa charges for all transaction types for M-Pesa.

To use our new M-Pesa Calculator, follow the steps below:

- Visit our main website and click on online tools, then M-Pesa charges calculator

- Alternatively, you can visit the link to access it directly.

- Scroll down until you see Enter the amount, and in the input field, just the amount you want to see its charges and press on Calculate

- You will immediately see a loader, and your charges will be presented to you within a few seconds.

M-PESA withdrawal charges

M-Pesa is completely owned by Safaricom, the leading telco provider in Kenya, and it is mainly known for its carrier services. M-Pesa as a whole first requires you to have an active registered SIM card to access all its services, such as Sending Money, Withdrawing cash, Buying Airtime, Loans and savings, Lipa Na M-Pesa, and accessing your account.

When it comes to using M-Pesa to withdraw cash, you have two options: either from an Agent or from an ATM. If you are doing it from an agent, you will need an Agent number and store number, and if you are doing it from ATM, you will also need an agent number. But hey, regardless of which methods you use, you must know the charges involved. Below are all the charges you must know.

M-Pesa Agent Withdrawal Charges

The best thing about using an agent to have you come is that it is much cheaper than using an ATM. However, there are restrictions: You can not withdraw less than Ksh 50 and a maximum amount of Ksh 250,000 per transaction.

Below is a table of all the withdrawal charges at the agent:

| Transaction Range (KSHS) | Transaction Charges(KSHS) |

|---|---|

| 1 – 49 | N/A |

| 50 – 100 | 11 |

| 101 – 500 | 29 |

| 501 – 1,000 | 29 |

| 1,001 – 1,500 | 29 |

| 1,501 – 2,500 | 29 |

| 2,501 – 3,500 | 52 |

| 3,501 – 5,000 | 69 |

| 5,001 – 7,500 | 87 |

| 7,501 – 10,000 | 115 |

| 10,001 – 15,000 | 167 |

| 15,001 – 20,000 | 185 |

| 20,001 – 35,000 | 197 |

| 35,001 – 50,000 | 278 |

| 50,001 – 250,000 | 309 |

ATM Withdrawal Charges

For those who prefer ATM charges, the following are the costs involved:

| Transaction Range (KSHS) | ATM Withdrawal Tariff (KSHS) |

|---|---|

| 200 – 2,500 | 35 |

| 2,501 – 5,000 | 69 |

| 5,001 – 10,000 | 115 |

| 10,001 – 35,000 | 203 |

How to Save Money with M-Pesa Withdrawal Fees

While using the M-Pesa for withdrawals, you should aim to save money as much as possible. Therefore, knowing when to use agent and ATM withdrawals can help you choose the most cost-effective method for meeting your needs.

Agent withdrawals are generally cheaper for smaller amounts, while ATMs may be more convenient for larger withdrawals despite higher fees.

Here’s a table comparing Agent vs ATM Withdrawal Fees for M-PESA in 2024:

| Transaction Range (KSHS) | Withdrawal from M-Pesa Agent (KSHS) | ATM Withdrawal Fee (KSHS) |

|---|---|---|

| 1 – 49 | N/A | N/A |

| 50 – 100 | 11 | N/A |

| 101 – 500 | 29 | N/A |

| 501 – 1,000 | 29 | N/A |

| 1,001 – 1,500 | 29 | N/A |

| 1,501 – 2,500 | 29 | 35 |

| 2,501 – 3,500 | 52 | N/A |

| 3,501 – 5,000 | 69 | 69 |

| 5,001 – 7,500 | 87 | N/A |

| 7,501 – 10,000 | 115 | 115 |

| 10,001 – 15,000 | 167 | N/A |

| 15,001 – 20,000 | 185 | N/A |

| 20,001 – 35,000 | 197 | 203 |

| 35,001 – 50,000 | 278 | N/A |

| 50,001 – 250,000 | 309 | N/A |

In the ATM withdrawal fee column, the N/A means it’s not applicable.

FAQs

How much to withdraw 5000 from Mpesa?

It will cost you KES 69 KES 5,000 from your M-Pesa account to withdraw KES 5,000 at an M-Pesa agent or ATM.

How much does it cost to withdraw 100 from the M-PESA agent?

It will cost your KES 100 to withdraw 100 from the M-PESA agent

And there you have it, friend. I hope that this guide has helped you with all about M-Pesa Withdrawal charges in Kenya for 2024. The Mpesa charges for withdrawal both from the agent and ATM vary depending on the amount you want to cash out.