The influx of Mobile lending apps has been on the rise with all the glory given to the dawn of M-Pesa in 2007. Loan apps in Kenya have become a solution, especially when an emergency strikes in any form. Many loan apps offer unsecured loans since, in most cases, they do not require any collateral. Many loan apps in Kenya also do not check without CRB, meaning that you can still apply for a loan even if you have a bad credit rating. These types of loans have become a darling in the pockets of many Kenyans. So, which loan apps in Kenya don’t do background checks?

This article will walk you through all that you need to know about loan apps in Kenya to help you decide which financial app to download.

What is a CRB Check?

For those who may or may not know, Kenya has various CRBs, mainly Metropol CRB, TransUnion, and Creditinfo. They all serve the same purpose of providing credit reports to lenders, including the “loan apps,” so that they can determine your eligibility

Therefore, the role of CRBs in financial systems can not be ignored. Today, many traditional lenders, such as Banks and SACCOs, still rely on CRBs to give you a loan. This is what CRB checks are and what has resulted in many Kenyans being locked out of borrowing. With the rise of Mobile banking and loan apps, there was a need for them to be regulated, and thus, in 2020, the Central Bank of Kenya restricted numerous mobile loan apps from accessing CRB services.

Through this move, loan apps without CRB checks in Kenya were born. Basically, the way they work is that instead of doing CRB checks, they seek to use alternative means, such as analyzing your M-Pesa Transactions, borrowing history, Data analysis techniques, etc., to determine your creditworthiness.

Top Loan Apps Without CRB Check in Kenya

By now, you might be wondering about these loan apps. Let’s analyze them individually and see what they offer.

1. Tala

Tala is perhaps the most well-known Loan app in Kenya, having attracted over 10 million downloads alone on the Google Play Store. It Entered Kenya in 2014 as “Mkopo Rahisi” before formally changing its name to Tala.

It is equally available in other markets, such as India, the Philippines, and Mexico.

Tala offers loans from Ksh 1000 with a limit set to Ksh 50,000. First-time applicants are given loans between Ksh 1000 and Ksh 2000; thus, you have to repay your loan time and keep using Tala loan services to reach the Ksh 50,000 limit. Tala loans attract interest rates of up to 0.3% daily.

The best thing about Tala is that it doesn’t rely on CRB; instead, the app has its own in-house algorithms that analyze your phone data, including your M-Pesa history, to determine your creditworthiness.

2. Branch

Mention the best loan Apps in Kenya, and the Branch will be Put on the Table. Well, there is a good reason for this: the Branch Loan App is among the few loan apps in Kenya with high loan limits. You can borrow anywhere from Ksh 3000 to as high as Ksh 300,000.

The best part about branch loans is that you can apply even if you are on the history books with various CRBs. However, on the downside, branch loans charge an interest of between 1.7% and 17.6%, depending on the amount you borrow.

The loan repayment periods range from 9 to 52 weeks, and the ability to apply for the loan at any time of day or night.

3. Zenka

Zenka is a good loan app in Kenya that offers loans with instant approval rates and zero interest rates for first-time applications

The lender offers loans in various amounts, mainly between Ksh 500 and Ksh 200,000. For first-time borrowers, the amount you are given is usually low, and thus, like Branch and Tala, you are advised to repay your loan on time and keep using its service to grow your Zenka loan limit.

The downside of using the Zenka loan app is that it’s among loan apps in Kenya that are reported to offer high-interest fees on recurring amounts you borrow, with interest rates up to 9-39%* of the principal amount.

When it comes to the loan repayment process, Zenka provides flexible repayment plans whereby you can extend your repayment period by 7, 14, or 30 days.

4. Opesa

Opesa loans have been operational in the country since 2019 and are operated by TK Limited. They have their Goods and downsides, and the positive is that they offer loans of Ksh 200 and Ksh 30,000wiothout any CRB check. On the downside, many users have reported that their loans attract highs, from 16.8%, depending on the amount borrowed, and when you fail to repay their loans on time, you will default to CRB immediately.

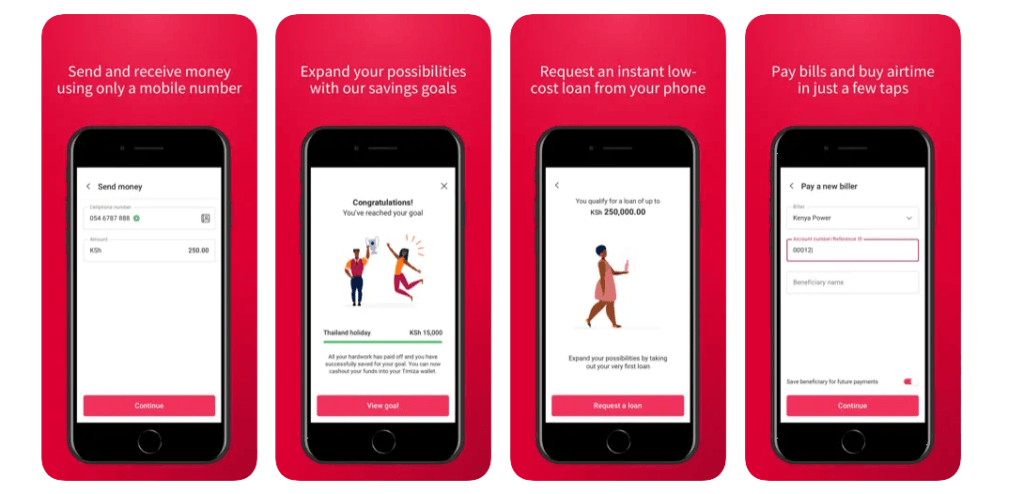

5. Timiza

Timiza is a loan app in Kenya affiliated with Absa Bank Kenya that launched in 2018. It provides loans to applicants without and those with ABSA Bank accounts, and the good part is that it doesn’t check CRB records.

You can apply for a loan by dialing *848# or using the app. You can borrow between Ksh. 1,000 and Ksh. 250,000, with a daily interest rate of 1% to 3% or a 15% monthly interest rate. However, take note that when you apply for any loans from Timiza, there is a processing fee of 5% of the Loan amount. The repayment period is only up to 30 days.

By the way, Timiza is not focused on just loans; it also offers other services such as sending money, paying bills, saving money, and even applying for insurance.

6. TiFi Slice

TiFi Slice is another loan app in Kenya that offers loans with an Instant approval process. The Fintech App is developed and operated by WAKANDA CREDIT LIMITED.

Although new t the world of lending apps in Kenya, they offer loans of up to Ksh 300,000, you must have satisfied various requirements to achieve this limit. Tifi Slice is the only lending app in Kenya that allows one to Borrow two loans simultaneously.

The application offers loan apps to individuals between 18 and 60 in Kenya who have met its terms and Cs. The Central Bank of Kenya licenses them and offers fast, instant approval rates

The bad news about this app is that the company hasn’t clearly stated the interest rates it charges on loan amounts, and the app is not accessible on the Google Play Store, as it claims on its website.

7. Hustler Fund

Although not a Loan Application, the Huster Fund is a financial platform owned by the Kenyan government that offers loans to various Kenyans, mainly with low-pay

The Hustler fund is managed by leading Telcos in Kenya ( Safaricom, Airtel, and Telcom). They analyze your phone details on M-Pesa, Airtel Money, and Telkom and decide on the Loan amount that you can be awarded.

The Hustler fund is divided into three Loan Prpductstaragetting various people as follows:

| Loan Product | Loan Amount (Kes) | Interest Rate | Repayment | Savings Requirement |

|---|---|---|---|---|

| Personal Loan Product (PLP) | 500 – 50,000 | 8% per annum | 14 days (extendable to 30 days) | 5% of the borrowed amount is directed to savings |

| Group Micro Enterprise Loan Products (GMELP) | 20,000 – 1,000,000 | 7% reducing balance | 5% of the approved amount directed to group savings | 5% of borrowed amount is directed to savings |

| Individual Micro Enterprise Loan Products (IMELP) | 10,000 – 200,000 | 7% reducing balance | 6 months | 5% of the approved amount directed to the borrower’s savings |

The hustler funds are applied strictly using the USSD code *254# on your line. Accept the terms, and then you can proceed to choose the loan product you want to apply for. You will be given the loan if you satisfy the criteria in place.

8. iPesa

iPesa is among the top lending providers in Kenya that offer quick loans with instant approvals and disbursements to M-Pesa

They give out loans from as low as Ksh 1,000 to as high as Ksh 0,000 with a minimum of 36% to a Maximum of 72% APR. iPesa also has flexible repayment periods between 91 to 180 days. The loan application is done after the app, and you will be awarded the loan if approved.

9. KCB Vooma

KCB Vooma is a product from the Kenya Commercial Bank (KCB). Its primary purpose is to disburse short-term loans to your M-Pesa account quickly.

With KCB Vooma loan, you can borrow loans as low as KES 1000 to as high as KES 300,000 with a repayment period of up to 30 days at an interest rate of approximately 5.91% per month

The downside of using KCB Vooma loans is that you must be registered with KCB Bank. You can apply for the loan through its KCB app or by dialing *522# and following the prompts.

10. M-Pesa Fuliza

Launched in 2019, M-Pesa Fuliza is a popular overdraft service in Kenya that has become a go-to option for anyone who needs fast cash.

Although it is not a long service, it is an “overdraft service” that supplements your low M-Pesa balance. The best aspect of using the overdraft service is that you can Fuliza as many times as you want as long as you operate within the limit.

You can dial 234# and select “Fuliza M-PESA to activate it

Benefits of Using Loan Apps

Loan apps present serval advantages over traditional banking, such as:

- It is easier to apply for a loan without Visiting its headquarters or offices

- Since Loan apps depend on your M-Pesa usage, they also offer fast approvals and disbursements to your M-Pesa number

- Many loan apps in Kenya do not require or check CRBs so that you are given a loan

- They have fewer requirements to meet, thus making them accessible to a broader audience

Risks and Considerations

While there are many benefits that they offer still, they have their own downsides that make them undesirable:

- Man Loan apps offer high interest on their loans, which makes it difficult to repay loans and leads to default

- They can lead to debt traps since it is easier to download an app and apply for loans

- Some loan apps can breach your data privacy by accessing your phone records and social media profiles to determine whether you’re eligible.

Remember, it is not advisable to use loan apps, and here at Mawese, we advocate only using them where there is a need. If you are looking for alternatives to loan apps in Kenya, you can try personal loans from a bank if you have a steady income, venture into microfinance, or even borrow from your friends or families