The number of mobile loan apps in Kenya will rise in 2025. By the end of Q1 2024, mobile loans in Kenya had a market share of about 52.79% of all active loan accounts, highlighting their significant growth (TransUnion Africa). While here at Mawese, we don’t advocate for active reliance on the Mobile Loans apps. Sometimes, life happens, and you may need to be in a situation where you need it. Only Opt will borrow from loan applications only if necessary and always go for credible applications that the Central Bank of Kenya licenses.

The M-Pesa platform, which was started in 2007, led to a massive influx of loan apps in Kenya. Technology, specifically mobile app development, has also contributed to that, but with M.Pesa, borrowing has become easier, cutting short the reliance on traditional mediums such as banks. The best part about utilizing loan apps is that they have a fast approval queue and no paperwork, but they can also have downfalls, i.e., high interest rates. Therefore, before you opt for a loan app, review its features and understand what it offers.

How Do Loan Apps Work in Kenya?

Loan applications have become valuable for many Kenyans, especially when accessing online credit. The best thing about them is that you have to own a smartphone, meet their requirements, and you are good to go. While the eligibility criteria for each loan may vary, they function the same way. You must download the respective apps from either the Google Play Store or the Apple App Store, register your details, get the application forms, and submit your loan details.

The tricky part is that many of them will always give you a small loan the first time you apply but with an opportunity to increase your loan limits while you keep using their services. Since most loan apps in Kenya do not check with CRB as required by the Central Bank of Kenya, most of them utilize your personal data and M-Pesa usage. Our transition details determine how much you can borrow.

Top Loan Apps in Kenya for 2025

The number of Licensed digital lenders in Kenya ( Mobile Loan Apps included) stands at 85 as of April 2025. Still, the CBK reports that 739 DCPs are waiting for approval; this shows that the numbers will even rise as the year progresses. The reason for licensing is just to regulate this niche-based market of Mobile loan apps and further protect consumers from being exploited by these loan apps.

Despite the regulations, we understand that choosing the best lender may not always be easy. But it doesn’t have to be that difficult; below, we have listed the top 20 best loan apps that you should really consider in 2025:

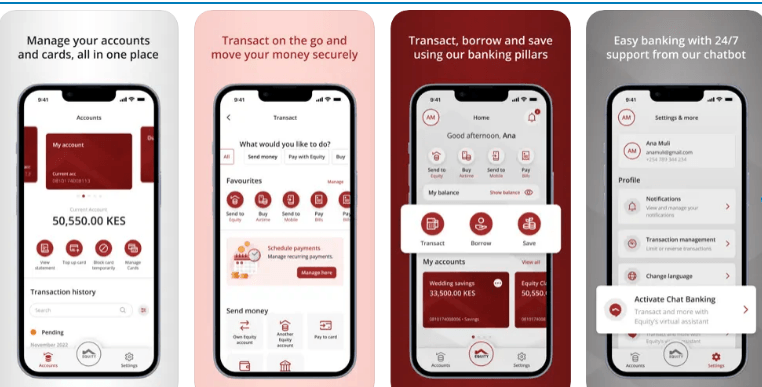

1. Eazzy App by Equity Bank Kenya

- Best for Equity Bank customers.

The Eazzy App is a product of Equity Bank, a commercial bank in Kenya, and it only offers loans to users who are members of the Bank. So long as you are eligible, you can apply for loans ranging from KSh 1,000 to KSh 3 million with interest rates between 2% and 10%, which might be slightly higher than most lenders. The best part is the repayment process, which varies depending on your loan limit, but the maximum period is two years.

Equity Eazy App

2. Branch Loan App

- Best for: Individuals With a Low Credit History

The Branch Loan App is a popular mobile app in Kenya that offers instant loans without a CRB check. With over 40 million downloads on the Google Play store, the App offers loan amounts ranging from Ksh 500 to Ksh 50,000. The branch loan app operates in up to four countries: Kenya, Nigeria, India, and Tanzania.

Branch app interest rates vary depending on the amount borrowed, but generally, they range between 7% but can reach up to 35%. Once awarded a Loan, a user is expected to repay the loan with terms from 62 days up to 12 months. They also offer a savings account with an annual return of up to 15%, with interest paid weekly.

Branch Loan App

3.MCo-op Cash by Co-operative Bank of Kenya

- Best for Salary earners

MCo-op Cash by Co-operative Bank of Kenya is a digital banking app that allows Co-Op bank customers to access their bank accounts, transfer funds, and even get loans. It offers loans of two types. The first is the salary loan, where customers can borrow 1.5 times their net salary and offer amounts from as low as Ksh 1,000 to as high as Ksh 500,000. The second is mobile loans ranging from Ksh 100,000 to Ksh 1 million. Of course, the amount borrowed is determined by many factors, including our credit score. The loan application can be made by using the app or using the MCo-op Cash USSD code *667#

Mco-opCash 5.0

4. Okash Loan App

- Best for those who may not qualify for loans from Banks

The Okash Loan App is another fintech platform that has operated in Kenya and Nigeria for quite some time. As long as you are registered with the Mobile app, you can apply for a loan, and the offer is between Ksh 2,500 and Ksh 5000,000. Depending on the borrowed amount, their loans attract Interest ranging from 5% to 15%, which can be repaid from 90 to 365 days.

Okash Loan App

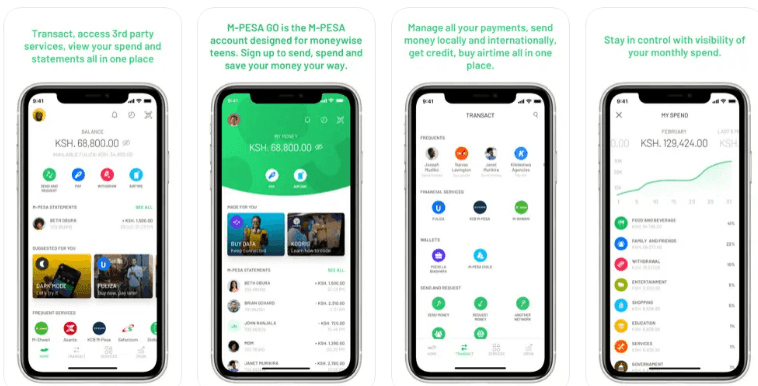

5. Mshwari by Safaricom

- Best for M-Pesa users who want easy access to funds

Mshawari is a loan service located within the M-Pesa platform. It was launched in 2012 as a result of a partnership between Safaricom and the NCBA bank. So long as you have an M-Pesa, you can quickly get loans from as low as Ksh 100 to as high as Ksh 100,000 with a facilitation fee of 7.5%. However, Mshwari is better known for its saving options, whereby a user can save as little as Ksh 1 and earn interest from 2% to 5% based on the Mshwari balance.

Mshwari Loan

6. Fuliza

- Best for M-Pesa Users with Low Account Balance

Although not a loan service, if you are an M-Pesa user and you are short of funds, you will need to know what Fuliza is. It’s an overdraft service that allows users to complete their transactions when short of cash on their M-Pesa wallet. To use the service, you need to opt in by dialing *234# on your Safaricom line. You can borrow from as low as Ksh 1 to as high as Ksh 70,000. However, beware that there are fees that are applicable when using Fuliza.

Fuliza

7.KCB M-PESA loan app

- Best for users who want to access loans and grow their savings simultaneously.

Anyone can register and use the KCB M-Pesa on the M-Pesa app so long as they have been using M-Pesa services for at least 6 months. Members can borrow from as little as Ksh 100 to as high as Ksh 1 million. However, one thing to note is that despite the amount borrowed, there is an 8.93% facilitation fee, which must be repaid within 30 days.

On the other hand, the platform offers two types of savings accounts. First, a Fixed deposit account requires a minimum deposit of Ksh 500 and an interest rate of 8.5% annually. Last, there is the Target savings account, where a member can deposit as little as Ksh 50 and earn interest rates of 6.3 % annually.

KCB M-PESA

8. Zenka Loan App

- Best for those looking for a second loan with higher amounts.

Zenka is a product of a prominent fintech platform in Kenya (Zenka Digital Limited) that offers unsecured loan amounts. The best part with Zenka is that you can apply for loans and get them even if CRBs lock you out. They offer loans from as low as KSh 500 to KSh 30,000.

Once you are given the loan, the repayment period ranges from 61 to 180 days. If you can’t meet the repayment terms deadline, Zenka allows you to apply for a repayment extension to avoid penalties.

Zenka Loan terms’ interest rates are risk-based, ranging from 9% to 39%, which is not ideal compared to many lending apps, especially the Max rate of 39%. The best Part with Zenka is that while first-time loans are usually low, as long as you repay your loans early and use the Zenka App frequently, the second loan amount can be higher.

Zenka Loan App Kenya

9.PesaPap by Family Bank

Best for Customers of Family Bank and those seeking a seamless banking integration for loan access.

Pesapap is a banking app from Family Bank that allows its customers to benefit from the financial institution’s banking solutions. Its customers can access many Loan options with interest ranging from 5 to 10%. You can apply for loans directly through the application or dial *325# from the same mobile number linked to your Bank account.

PesaPap by Family Bank

10.Wezesha by Absa Bank

- Best for SMEs seeking quick access to capital without the need for collateral

The Wezesha app, or Wezesha Stock, is an Absa Bank product tailored for small and large businesses. The key features include loans up to Ksh 6 million with repayment periods of up to 60 months, unsecured LPO financing of up to Ksh 12 million, secured loans of up to 10 years repayment period, and Secured loans of up to 10 years repayment period.

The interest rates are either fixed or variable, depending on your chosen option. You can apply for the loans by registering at https://wezesha.agiza.io/register.

11. HF Whizz app

- Best for users seeking short-term loans.

HF Whizz is a mobile application for Android and iPhone managed by HF Whizz Limited. Once registered and eligible, users can borrow up to Ksh 10,000. However, while borrowing, be aware of the interest rates, which can go up to a maximum of 25%.

HF Whizz Loan app

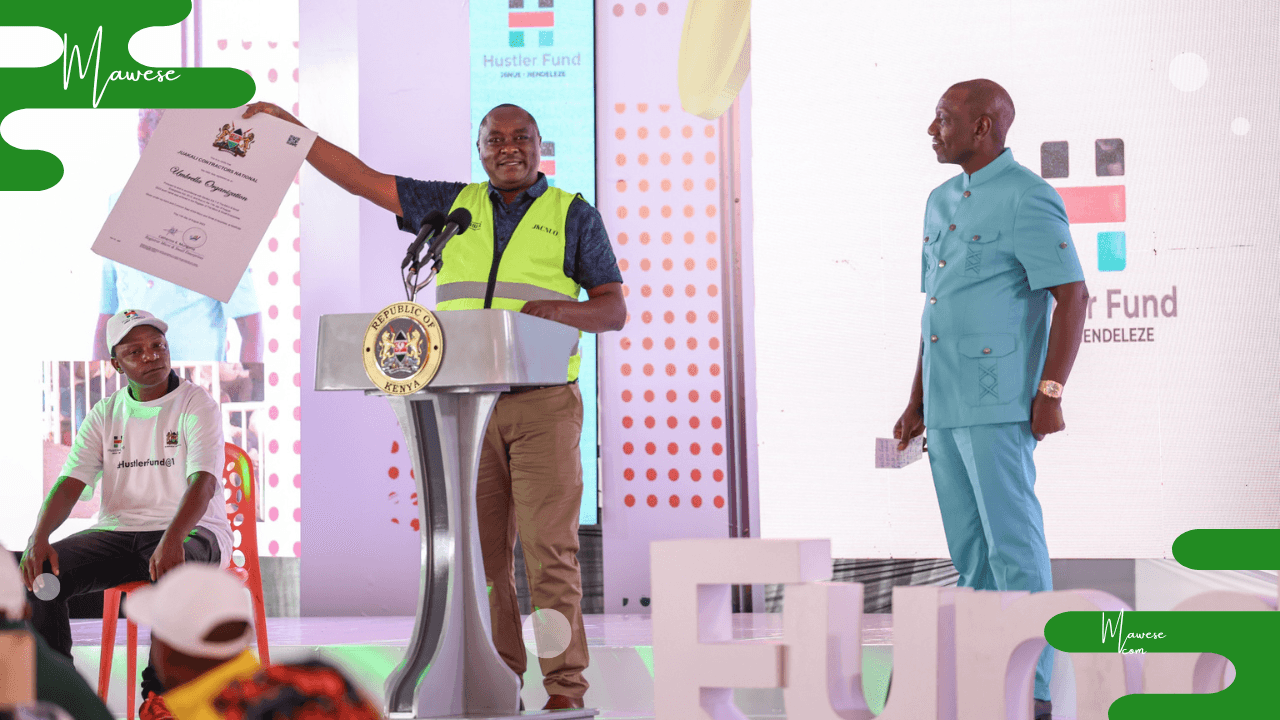

12. Hustler Fund

- Best for Small business owners in the informal sector

The Hustler Fund is a Kenyan government initiative launched in 2022 to uplift those in the informal sector financially. With an initial capital of Kshs 50 billion, the fund offers loans at a competitive annual interest rate of 8%, the lowest in Kenya as of 2025.

However, the Hustler fund is unique because it also acts as a savings account. For every amount borrowed, 5% of it goes to borrowing, and you can access it upon retirement or early withdrawal if eligible.

Furthermore, the Hustler fund is divided into main products: Personal Finance loans (Kshs 500 to Kshs 50,000), Micro Loans, SME Loans, and Start-Up Loans, which offer loans up to a Million Kenyan shillings. Registration is done by dialing *254# on your SIM card ( Airtel, Safaricom, or Telkom)

13. NCBA Loop App

Best for NCBA Bank customers. Offers seamless banking integration for those in the bank’s ecosystem.

As the name suggests, the app is a product of NCBA Bank and thus is available only to NCBA bank customers. It offers a range of digital banking solutions, including loan applications. The app provides personal loans of up to Ksh 3 million and overdrafts of up to Ksh 100,00 to those who are eligible only.

What makes the NCBA lop app unique is its number of features. For example, users can benefit from linking multiple bank accounts, thus making it easy for them to track expenses and budgets.

NCBA Loop Loan App

14. SC Juza by Standard Chartered Bank

- Best for users who want quick loans without the need for documentation.

In early 2024, Standard Chartered Bank Kenya launched a mobile app called ” SC Juza” for its bank customers to easily access short-term loans. As long as you are legible, you can borrow loans ranging from Ksh 1,000 to Ksh 100,000.

The interest rate lasts up to a month, but you should pay attention to the applicable interest rates of 1.6% per month on the borrowed amount and the 5.5% processing fee also charged on the same amount.

While the charges may be high, the advantage is that the app comes with features that are quite useful to you as the consumer, such as the ability to detect and prevent sim swapping.

SC Mobile Kenya

15. M-Fanisi by Maisha Microfinance Bank

- Best for Airtel Money users who need Short-term Loans.

M-Fanisi is a mobile banking solution offered by Maisha Microfinance Bank. The product is designed to offer loans to any Kenyans who operate and own a smartphone. M-Fanisi offers loans, savings accounts, and fixed deposit accounts, but surprisingly enough, they don’t charge interest rates and rely on facility fees upon repayment as follows:

- 7-day loan: 3% facility fee

- 14-day loan: 5% facility fee

- 30-day loan: 7.5% facility fee

In addition to the loans, you can also open a fixed deposit account earning between 8.50% and 11.25% per annum, depending on the deposit period, and savings accounts that yield 7% per annum.

M-FANISI

16. Tala loan app

- Best for users with low CRB Rating

The Tala Loan app is perhaps the country’s most well-known mobile loan application. It was launched in 2014 as “Mkopo Rahisi” before becoming what it is today. Tala is available in Kenya, the Philippines, and Mexico.

Anyone can register for Talal loans and be awarded loan amounts from Ksh 1,000 for first-time borrowers to as high as Ksh 50,000. The Tala app is almost among the few financial apps in the country, with competitive interest rates starting at 0.3% daily. There are late repayment penalties of 8% if you fail to pay your loans on time.

Tala loan app

17. Timiza from Absa Bank

- Best for individuals with Bad Credit Histories.

If you are an ABSA bank customer, they have a financial application dubbed “Timiza” through which you can easily find all the banking solutions. The app allows you to benefit from loan applications, savings, bill payments, etc.

The loan application can be made directly via the app, but remember, Timiza charges an interest rate of 1.083% per month along with a 5% facilitation fee on the loan amount, which is disbursed directly to your account.

Timiza Loan App

18.iPesa Loan App

- Best for Emergency short-term loans

The iPesa loan app is another significant player in Kenya’s lending market. It’s a trustworthy lender, attracting over 1 million downloads and a high user rating of 4.5 out of 5 on Google Play Store.

If you are eligible, you can apply for loans from Ksh 500 to Ksh 500,000. The iPesa loan app offers high interest rates ranging from 36% to 72% annually, with no additional service fees charged. You can repay your loan in 91 to 180 days, and the best part is that you can repay the whole amount in monthly installments.

iPesa Loan App

19. KCB Vooma app

- Best for users who want to manage finances digitally

It is a Mobile wallet specifically for KCB bank customers. With the app, you can quickly pay bills, carry out money transfers, do savings, and, most importantly, apply for various loans. Loan applications are done through the app or by dialing *844#.

Once you register, the loans offered on Vooma range from as low as Ksh 1000 to as high as Ksh 300,000, with a repayment period of up to a month. The best part is the low interest rates, starting at just 0.2% but varying depending on the chosen repayment duration of either 1,7,14 or 30 days. If you link your KCB bank account with KCB Vooma, you can benefit from high daily transaction limits of up to Ksh a million.

KCB Vooma Loan app

20. Saida Loan App

- Best for small business owners

The Saida Loan App is another lending application that does not check with CRB. It is also among the few lenders in the country with low loan limits, offering loans ranging from Ksh 600,00 to as high as Ksh 25,000. Since they don’t check with CRB, they access your smartphone data to determine how much you will be given. The repayment period is up to 30 days, and a processing fee of 5% on the principal amount borrowed is charged.

How To Choose the Right Loan App In Kenya

With the loan apps saturated in the Kenyan market, we recommend you take the time to answer each one before deciding to settle on one. Below are some key factors that you should take into consideration:

- Interest Rates and Fees

- Loan Limits

- Requirements

- Repayment Terms

- Customer Reviews

FAQ

Which app gives loans instantly in Kenya?

Instant loan apps are applications that, as soon as you qualify for the loans, disburse them within minutes to your Mobile wallet (Airtel Money, M-Pesa, or T-Kash). Some of the reliable apps in 2025 are:

- Eazzy App by Equity Bank Kenya

- Branch Loan App

- Okash Loan App

- KCB M-PESA Loan App

- Zenka Loan App

- HF Whizz App

- NCBA Loop App

- SC Juza by Standard Chartered Bank

- Tala Loan App

- iPesa Loan App

- KCB Vooma App

- Saida Loan App

Where can I get a quick loan of 100k in Kenya?

The best application that offers loans of up to Ksh 100,000 in Kenya is the SC Juza App. The application process is quite easy, but the downside is that the app is only available to Standard Chartered Bank consumers.

Which loan app can I borrow up to 50k?

Tala Loan Apps offers loans from as little as Ksh 1000 to a maximum limit of Ksh 50,000.

How do I check if I qualify for a loan?

Most loan apps in Kenya offer loans to all applicants, even if you are blacklisted with the CRB. Instead, they rely on the app’s algorithms and smartphone data to check on the loan amount that you will be given. For most, the first is always a lower limit, but as you keep using the app and repaying your loan limit, it grows with time.

What is the highest amount I can borrow from Okash?

In Kenya, Okash offers loans between Ksh 2,500 and Ksh 5000,000

How do you get a quick loan with M-Pesa?

To get a loan with M-Pesa, you need to have an active Safaricom line linked to M-Pesa, which should have been in use for at least 6 months. M-Pesa offers Mshawri loans to all eligible customers. You can apply for them by accessing Loans and savings on M-Pesa>> M—Shwari>> and requesting a loan.

Conclusion

Well, we hope you now have a clear overview of the loan apps to consider for borrowing in 2025. Remember, as much as the various apps have different features, there is actually no best loan app since they could all lead you to a debt trap. So, it is always up to you to do your own research and choose the option that matches your financial needs.

Am I qualified for a loan

0759191285

Am victor

Hello Victor , Which Loan do you want to apply

I need loan