The rise and adoption of the M-Pesa Mobile wallet have genuinely been a game changer for all Kenyans at large. And it’s not about Kenya. Today, M-Pesa is quickly being used in many countries, especially in Africa, where it has been widely adopted. Talking of its adoption here in Kenya, Equity Bank has made it possible to send and receive money from M-Pesa. By knowing your Equity Bank Paybill number, you can easily Transfer Money from your M-Pesa wallet to your Equity Bank account.

If you are new to using this technology, this guide will walk you through the process and steps to follow, so make sure to read to the end.

How to Send Money from M-Pesa to Equity Bank

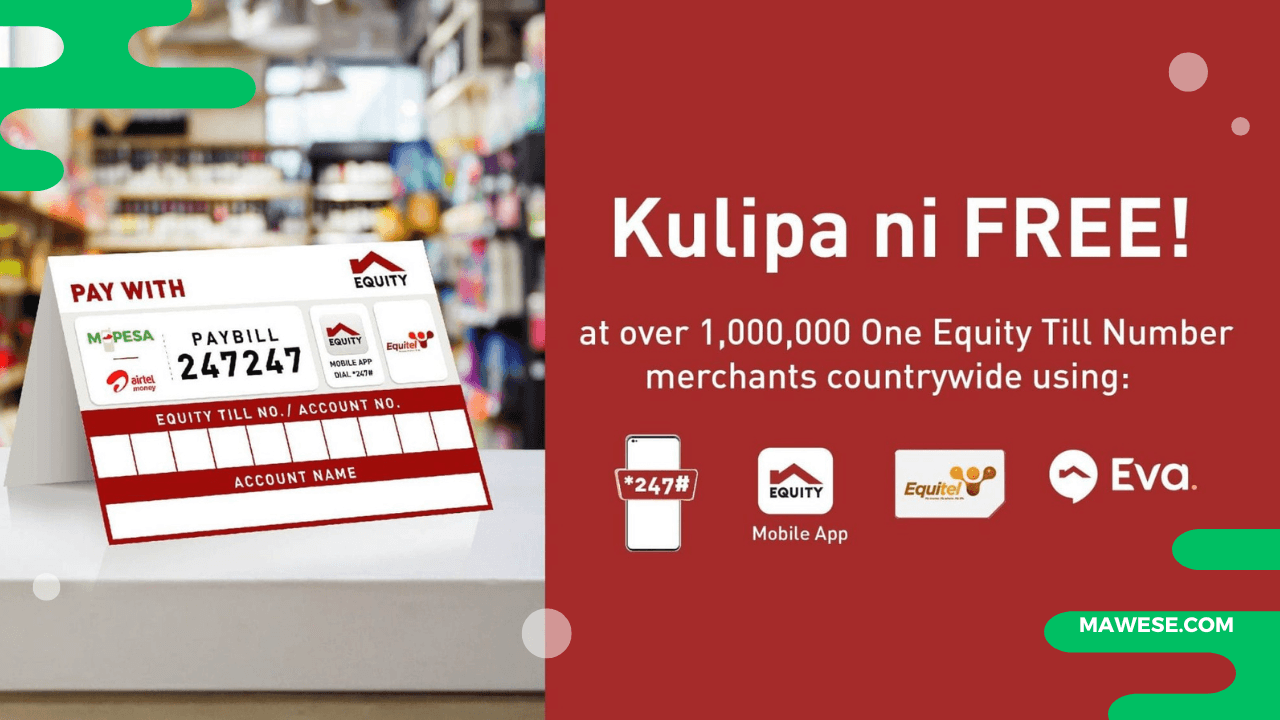

In the past, banking meant that you had to visit your Bank Branch to get assistance. If you are an Equity Bank user, you do not need to go that route. Just by using Equity Bank Paybill number 247247, you can easily move money from M-Pesa to the bank within seconds.

Here is how:

- Open the M-Pesa Menu On your phone.

- Select “Lipa na M-Pesa”

- Choose “Pay Bill”

- Enter the Paybill Number 247247 and press “OK.”

- Enter Your Equity Bank Account Number

- Enter the Amount you want to transfer and press “OK.”

- Enter Your M-Pesa PIN

- Confirm, and once you’re sure, press “OK” to send the money.

Once the transaction is successful, you’ll receive a confirmation message from M-Pesa and your bank confirming that it went through.

M-Pesa to Equity Charges

Is sending money from M-Pesa to Equity free? No, it’s not. M-Pesa will charge you a transaction fee for using the Equity Paybill to transfer money from your M-Pesa account’s balance.

The charges vary depending on the amount that you are sending. Mpesa paybill applies three various tariffs: the Mgao tariff, where both the business and customer share transaction charges; business traffic, where the customer incurs all the charges, and the business doesn’t; and, lastly, the customer tariffs, where the customer doesn’t pay anything but the business pays all the charges.

Since, in this case, you are sending Cash from your M-Pesa wallet to Equity Bank, you will be subject to the business tariffs as follows:

| Bands (KES) | Fee (KES) |

| 1 – 49 | 0 |

| 50 – 100 | 0 |

| 101 – 500 | 5 |

| 501 – 1,000 | 10 |

| 1,001 – 1,500 | 15 |

| 1,501 – 2,500 | 20 |

| 2,501 – 3,500 | 25 |

| 3,501 – 5,000 | 34 |

| 5,001 – 7,500 | 42 |

| 7,501 – 10,000 | 48 |

| 10,001 – 15,000 | 57 |

| 15,001 – 20,000 | 62 |

| 20,001 – 25,000 | 67 |

| 25,001 – 30,000 | 72 |

| 30,001 – 35,000 | 83 |

| 35,001 – 40,000 | 99 |

| 40,001 – 45,000 | 103 |

| 45,001 – 50,000 | 108 |

| 50,001 – 70,000 | 108 |

| 70,001 – 250,000 | 108 |

Other Methods To Send Money From M-Pesa to Equity

Those who are not comfortable using the Paybill Method will be glad to know that Equity Bank provides alternative ways to transfer cash from your mobile wallet to your account. Below are two Popular alternatives to use:

Equitel

Equitel is a mobile SIM card launched by Equity Bank specifically for its customers. It directly integrates all Equity Bank services that can be accessed from mobile phones. For example, you can send money, access loans, etc., using the Equitel SIM card.

To send money using Equitel, follow these simple steps:

- Go to the Equitel menu on your phone.

- Select “My Money.”

- Choose “Send Money.”

- Select “To Bank Account.”

- Enter your Equity Bank account number.

- Enter the amount you want to transfer.

- Confirm the details and send.

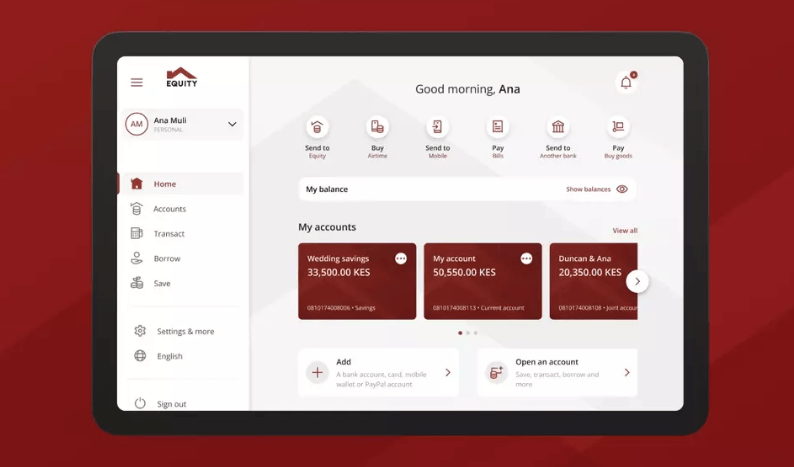

Equity Mobile App

Using the Equity Mobile App is even more straightforward, as all you need is your M-Pesa PIN.

- Sign in to the Equity Mobile App

- In your accounts in the Home section, select “Send to Equity”

- Enter M-Pesa Number and select the receiving account number. Immediately you do so and submit, and you will receive a Prompt on your Phone to enter your M-Pesa PIN to complete the send money process

- Once successful, you will receive a notification from Equity and M-Pesa confirming the transaction

The process of sending money from M-Pesa to Equity is easy as long as you know where to look. For starters, using the Equity-Mpesa pay bill number 247247 is recommended. However, the bank still has other alternatives, such as using Equitrtel SIM cards and Internet banking solutions.