Education is the foundation that defines the success of every man in society if it is well put into mind and heart. In Kenya, education entails going to school from childhood to adulthood. But sadly enough, not all students in Kenya can access education, especially when it comes to advancing to higher institutions. Luckily enough, there are free scholarships and even loans that one can apply for to finance their education and turn their dreams into reality. Such include the Higher Education Loans Board (HELB), which offers loans from Ksh 40,000 to Ksh 60,000 per academic year for eligible students.

Even with organisations such as HELB, many still have problems familiarising themselves with the portal. But it is not as hard as it seems anyway. We understand that it is not every day that you have the right information to navigate all corners of the portal, and thus, in this guide, we will walk you through all you need to know about HELB in Kenya, from the registration process to even how to apply for loans.

What is the HELB Portal?

If you are going to join a university or college in Kenya and you need financial support from the first to the final year, then the HELB portal will be your academic friend throughout. HELB, short for Higher Education Loans Board, is a state-owned parastatal in Kenya established in July 1995 by an Act of Parliament.

Its main purpose is to offer loans to students who are unable to sustain themselves as they pursue their academic journey. HELB offers loans for both undergraduate and postgraduate students and also offers Scholarships and partner funds. Anyone can apply for these loans so long as they meet the requirements with the purpose of paying back when they are done with their studies.

Is the HELB portal open for 2024?

HELB allows students to apply for the various products it offers yearly. When the portal is opened, applicants are advised to make their applications before deadlines so as to avoid being locked out. As of the time of writing this article, the HELB loans for undergraduates closed on 2024-11-30. So this means if you are looking to apply for this product, you will have to wait until next year when it will be opened again.

How To Register on the HELB Portal?

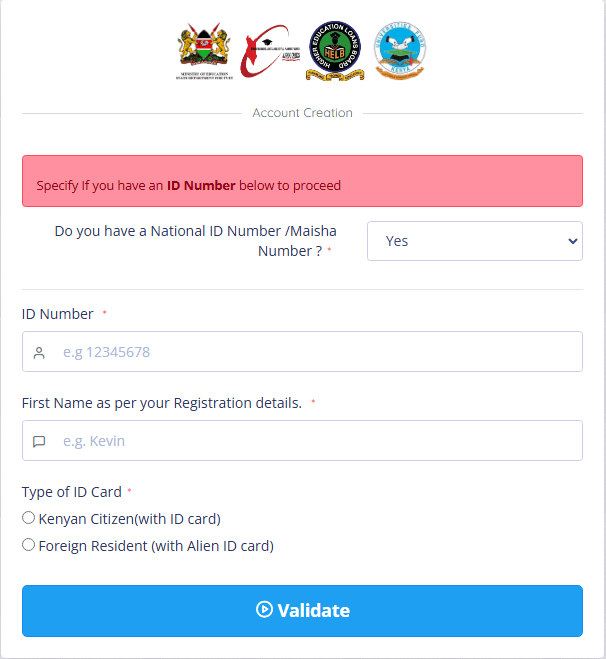

Accessing all that HELB offers starts with one mandatory procedure: registering at the HELB portal. Below is how you can easily do so:

- Visit the HELB portal at https://www.helb.co.ke/

- On the main webpage and the top of the navigation bar, hover on Portals and then select Student Portal

- Fill in the required details, including your name, date of birth, and ID number

- Submit your information

Once registered, make sure that you verify your email so that you can access your account. To get an activation link for your HELB account, follow these steps:

- Open your email inbox using your phone or computer.

- Look for messages from the Higher Education Loans Board (HELB) in your Gmail inbox.

- Check your Spam/ Junk folder if it is not in your Inbox

- Open the email and click the link to begin the account activation process.

- Once you click the link, enter the auto-generated code delivered to your phone number.

- Complete the Activation Process

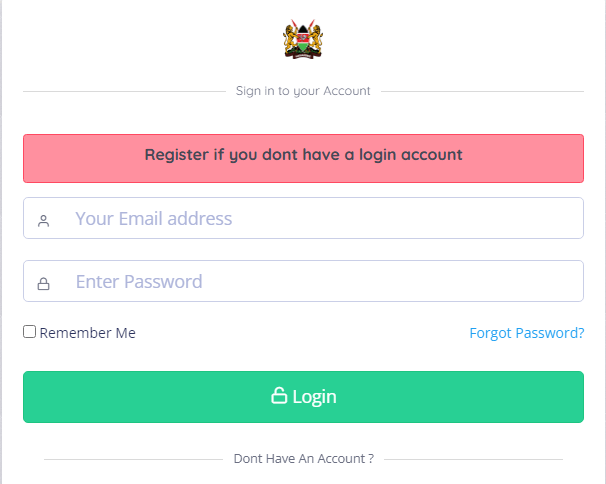

HELB Portal Login

Logging into the portal is easier, and you only need to use the credentials you registered with in the previous process. Here is how

- Go to the HELB portal website at the portal.hef.co.ke/auth/sign in.

- On the login page, enter your registered email address and password.

- Proceed to the login button to make red in the green button. If your details are correct, you will be redirected to your HELB dashboard.

How do you apply for a HELB loan online?

With the advancements in technology and the HELB’s launching of several products, such as its official website and app, it has become easier than ever to apply for HELB loans in Kenya. It all starts with first identifying the category of loan that you want to apply for and meeting its requirements before you are given that loan.

Products on offer

The Higher Education and Loans Board offers three loan types. The first is loans, which include the Jielimishe loans for salaried and undergraduate loans and TVET loans for students just joining colleges and universities in Kenya. All these loan types range from as Low as Ksh 40,000 to as high as Ksh 60,00. However, you should know that not all applicants get the same loan amount when it comes to how much you can receive. The amount you are given is influenced by the information you provide during the application process.

The second product on offer is scholarships applicable only to postgraduate students, with Ksh 200,000 given to those doing a master’s for two years and Ksh 450,000 for PhD programs in three years. The last product on HELB’s bucket list is the Partner Funds, which result from partnerships between HELB and various positions in the country.

Requirements

Now that you know which HELB products are on offer, meet the loan requirements before applying. While the requirements vary based on the product that you are applying for, below are the general eligibility criteria to meet:

- You must be above 18 years of age

- Scanned copies of the National identity card, both yours and your parents, are required.

- A death certificate if any of your parent is deceased.

- Copy of KRA PIN certificate

- Letter of admission to the institution you are admitted

- Colored passport photographs

- Relevant academic certifications, especially for postgraduate students

- The bank account number where your money will be deposited

Application process

Once you meet the requirements for the product that you are applying for, the application process is very easy. All you need to do is follow the process below:

- Log back in to your HELB account and navigate to your dashboard

- On the account, look for the apply button, click on it, and proceed to fill out the presented HELB Loan application form. While doing so, make sure to provide accurate information so that you are not disqualified

- Once you are done filling out the form, download it on your computer and make sure that you print two copies of it

- HELB requires that local authorities stamp the printed forms. Make sure to obtain stamps that are required and that they are signed

- Attach all the required documents as stated on the last page of the HELB application form

- when everything is done. Here is the catch: HELB requires you to submit the signed application form at its headquarters in Anniversary Towers in Nairobi

Now, after submission, you only need to wait for your application to undergo the verification process and approval. If everything is okay, you will be assigned a serial number, and a loan of any amount will be allocated and channelled to your bank account number.

How to apply for a subsequent HELB loan

The best part about HELB loans is that even after you have been given your first loan, you can reapply for it again and again until you complete your studies. This whole process is called the Subsequent loan application process and only applies to continuing students.

The application process is easy and does not entail any filing process, and it is only done using the HELB App. Here is how you can do it yourself:

- Download the HELB App from the Google Play Store.

- Proceed to register on the app using the email and phone number you used on the HELB app.

- Verify your account and proceed to set a unique 4-digit PIN, which you can use whenever you want to log into the app.

- To apply for the subsequent loans section, select the financial year you are applying for and then read and fill in the presented financial mastery guidelines.

- When you’re done filling out the loan forms, proceed to submit them. HELB will then send you a text message on your number with your loan serial number and reference number, indicating that you have successfully applied for a second loan

You can now wait for the HELB disbursement process to kick in. The process of receiving HELB money varies depending on a number of factors, and it can take up to 2 months for you to receive funds.

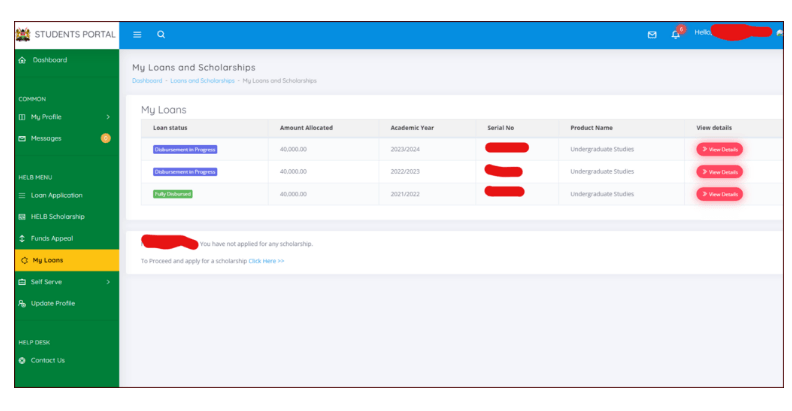

Checking Your HELB Loan Status

The HELB portal has made it easier to track your loan status once you apply for it. You can do it yourself by following the process below:

- Log in to your HELB account

- Go to the ‘Loan Status’ section

- Here, you can see your loan status, as indicated in the first column. The status can be Verification in Progress, Allocated, Disbursement in Progress, or Fully Disbursed.

HELB Contacts

For immediate assistance, you can reach out to HELB using the contacts given below:

- Physical address: Anniversary Towers, 19th Floor, Nairobi

- Postal address: P.O. Box 69489-00400, Nairobi, Kenya

- HELB helpline number: 0711052000

- Email address: [email protected]

Conclusion

And there you have it, friends. This is all you need to know about the HELB Portal, from Registration to making Loan applications. The HELB portal is your one-stop shop for getting University or college funding in Kenya. By understanding every step we have listed in the article, you can easily apply for any HELB Product. If you encounter an issue during the process, do not hesitate to contact HELB for assistance. I wish you all the best. Let me know how it goes in the comment section below.