As of March 18th, 2025, the Higher Education Loans Board (HELB) has confirmed that it has released Ksh 1.56 billion to HELB beneficiaries across all Kenyan universities and colleges. As a higher learning student in Kenya, understanding the timeline for HELB disbursements is very essential. When it comes to how HELB distributes funds to students all over Kenya, the process has been made easier. Unlike in the past, where disbursements were only done via bank accounts, with the downside being that it takes a lot of time for funds to arrive at your bank account, varying from one bank to another, HELB has now partnered with M-Pesa, making the process much easier.

So, how does HELB M-Pesa disbursement work? How long does HELB take to release funds? If you have all these questions, don’t worry. In this guide, I will walk you through all that you need to understand about HELB M-Pesa disbursements in 2025.

How to Register for HELB M-Pesa Disbursement

The HELB M-Pesa disbursement process allows all students who have applied for HELB and been approved for disbursement to receive their HELB loan money through their M-Pesa wallet. However, the process requires students to register for the service, which is quite easy and can be done directly with their Safaricom number.

The process requires meeting certain requirements, which are as follows:

- You will need a Safaricom-registered phone number

- Your phone number must have been in use for the last 90 days and linked to M-Pesa

- You must have an active HELB account fully verified through the HELB Student Portal

- You must be actively enrolled in a HELB-approved institution in the country and be a sitting student for the current enrolled semester (for university students) or term (for TVET students)

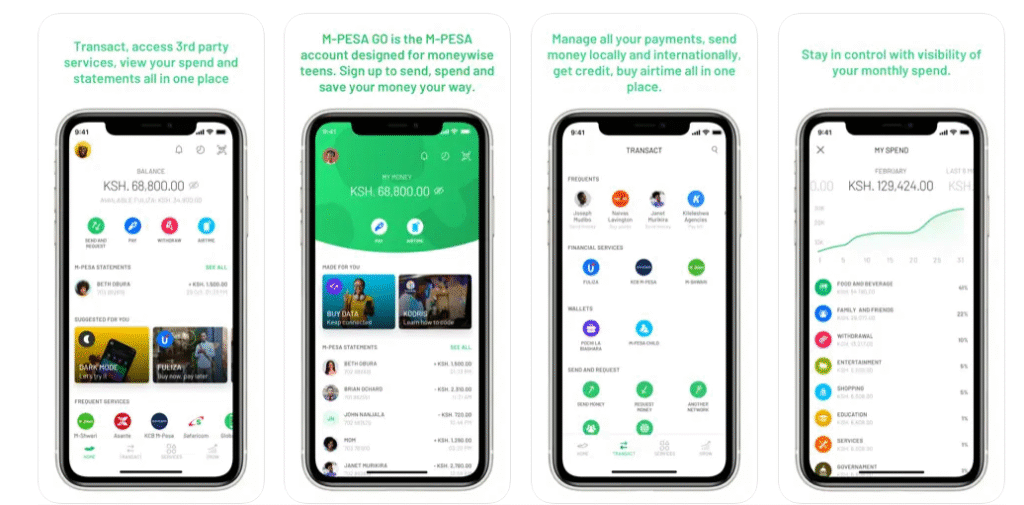

To register for HELB M-Pesa disbursement, the process is easy and can be done in two ways. One method is dialing *642# on your phone and following the rest of the prompts; this is the easiest registration process. Alternatively, the process can also be completed by using the M-Pesa Super App, which you can directly download via the Google Play Store or Apple App Store. Once you’ve downloaded and registered your details by following the onscreen instructions, and when logged in, open the app and select Financial Services from the dashboard, then tap the HELB icon featuring their blue-and-white logo.

If you are a first-time user, you will see a prompt to Activate HELB Services, which requires accepting Safaricom’s data-sharing terms under Kenya’s Data Protection Act. Proceed and complete the biometric verification process, which requires you to provide your national ID number and verify it. You can follow the rest of the prompts as guided by the system to get the HELB mini app up and running on your smartphone.

How to Withdraw HELB Funds via M-Pesa

The same methods that you used for registration for the disbursement M-Pesa process can also be used to withdraw funds directly to your M-Pesa number. Here is how:

USSD Method (642#)

- Dial *642# on your phone.

- Wait for the menu to load and provide your M-Pesa PIN if requested.

- Next, select the option for Upkeep Withdrawals.

- Proceed to specify the type of withdrawal (i.e., full amount or partial) and enter the amount you want to withdraw.

- Confirm the transaction with your M-Pesa PIN.

M-Pesa Super App Method

The process is as follows:

- Open the M-Pesa app.

- Go to the “Services” section.

- Tap on “Education.”

- Select “HELB.”

- Follow the prompts to withdraw your funds.

Note

Both methods described above will allow you to withdraw funds directly to your M-Pesa account. However, while doing so, you need to be aware of the M-Pesa withdrawal charges for different amounts, which are as follows: typically, HELB usually disburses funds to students between a minimum of Ksh 40,000 and a maximum of Ksh 60,000, and withdrawing these funds will cost you the following:

| Transaction Range (KSHS) | Transaction Charges(KSHS) |

|---|---|

| 1 – 49 | N/A |

| 50 – 100 | 11 |

| 101 – 500 | 29 |

| 501 – 1,000 | 29 |

| 1,001 – 1,500 | 29 |

| 1,501 – 2,500 | 29 |

| 2,501 – 3,500 | 52 |

| 3,501 – 5,000 | 69 |

| 5,001 – 7,500 | 87 |

| 7,501 – 10,000 | 115 |

| 10,001 – 15,000 | 167 |

| 15,001 – 20,000 | 185 |

| 20,001 – 35,000 | 197 |

| 35,001 – 50,000 | 278 |

| 50,001 – 250,000 | 309 |

Tracking HELB Disbursement Status

Did you know you can also track down your HELB disbursement status? While there are various methods that you can use for me, the technique that has personally worked out in the past is by directly using the HELB student portal account.

All you need to do is log in to your account, and while in your dashboard, navigate to the “My Loans” section. Here, you’ll find a breakdown of your disbursement history, including batch numbers, payment dates, and amounts disbursed.

Still, the* 642 # USSD code is also available for those who want to check their HELB status via SMS.

Questions And Answers

How do I check my HELB loan balance via SMS?

Follow these steps:

You will need to register to check the HELB loan balance via SMS. First, send REGISTER#ID No (e.g., REGISTER#12345678) to 5122 to register. Then, to see your balance, Send an SMS with FirstName#ID No (e.g., JOHN#12345678) to 5122.

How do I find out my HELB disbursement date?

For real-time updates, check the HELB Student Portal (portal.hef.co.ke) or dial *642# .

Can HELB send money directly to M-Pesa?

Yes! Since 2023, HELB disburses upkeep funds directly to M-Pesa via the HELB Mini App (under “Services” in the M-Pesa Super App) or USSD code *642#

What is the latest news on HELB disbursement?

As of May 2025, batches 6124, 6100, and 6006 were prioritized, while 6174 and 6168 faced delays due to verification issues. HELB disbursed Ksh1.56 billion to 65,000+ students in March 2025.

The end

I hope that this article has given you a clear overview of how the HELB M-Pesa process works in 2025. I have walked you through the registration process and explained how you can easily access your funds directly to your M-Pesa wallet.

Key takeaways for success include double-checking personal details like your Safaricom-registered number and National ID verification because if details do not align with what is in your student portal, this might lead to payment delays.

In addition, for those applying for subsequent semesters, make sure to apply at least six weeks before deadlines as HELB prioritizes earlier batches when it comes to how they disburse funds.

All the best! If you have questions, I would be happy to respond to them in the comment section below.