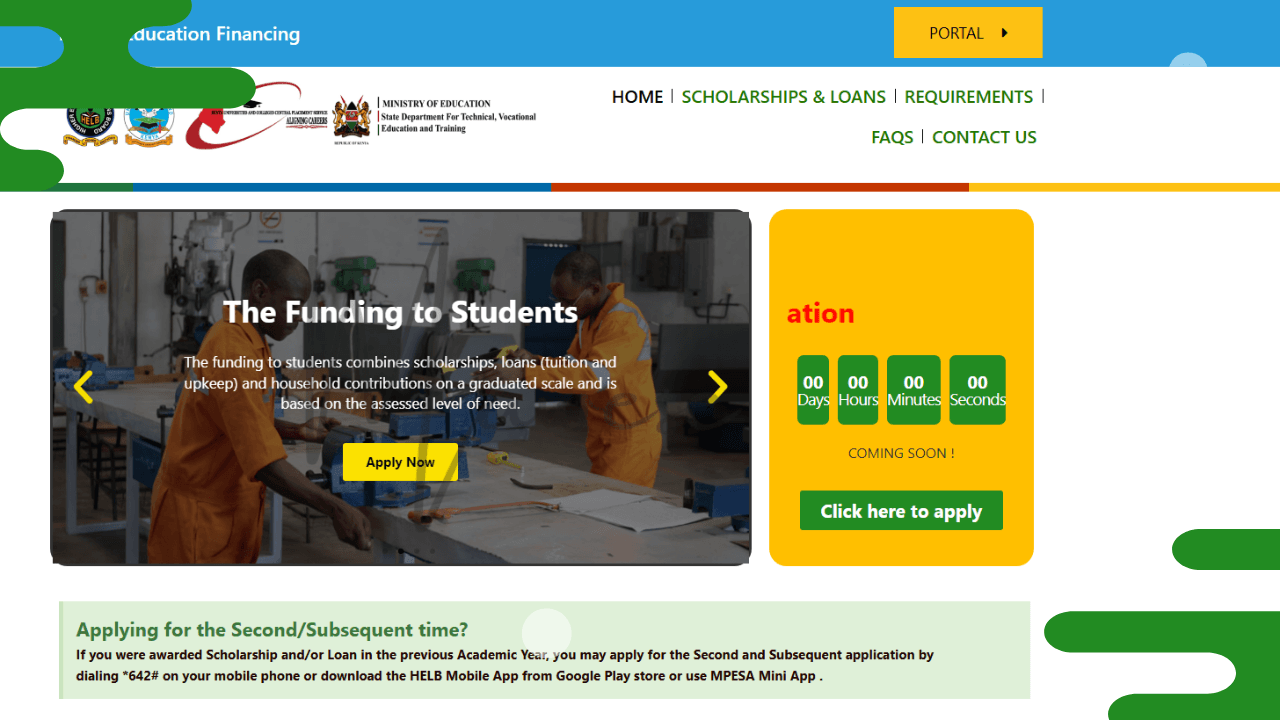

It has long been said that education is the key to success (at least for many), but not everyone can afford it. Education in Kenya is complimentary, at least for those studying in Public schools owned by the government. Still, for those looking to join universities and colleges, one must pay a considerable amount of money to access these places of learning. For those who need to continue with higher education, there are various scholarships and loans available in Kenya, such as HELB and HEF loans.

If you have just finished your secondary education and you are looking to get your hands on HEF, don’t worry. In this guide, we will walk you through everything that you need to know about the HEF portal. Everything from registration to the loan application process is covered.

What Is HEF?

When the current Kenyan Government came into power in 2022, one of the manifestos was to ensure equality in access to higher education by ensuring that even those who can afford it can do so. For this reason, the New Funding Model was introduced to address such issues, as well as the challenges faced by TVETs and universities, specifically inadequate funding due to increased enrollments.

On the other hand, for students, the Higher Education Financing (HEF), popularly known as the HEF Portal, was unveiled, allowing them to apply for various loans and scholarships. But wait, one would say there is HELB; yes, it is there, but the main difference is that HEF is student-centred, giving out loans to applicants based on their levels of need. It does so by using a Means Testing Instrument (MTI) methodology. In doing so, student funding comprises three main factors: scholarships, loans, and household contributions.

How To Register on the HEF Portal

The process of creating an account on the HEF platform is quick and easy, but before you do that, you must be formally admitted to a recognized institution in the country as a KUCCPS Student. All you need to do is follow the Process below:

- Visit the official website for HEF at https://www.hef.co.ke/

- On the top navigation, look for “Portals” and select it, and then navigate to register

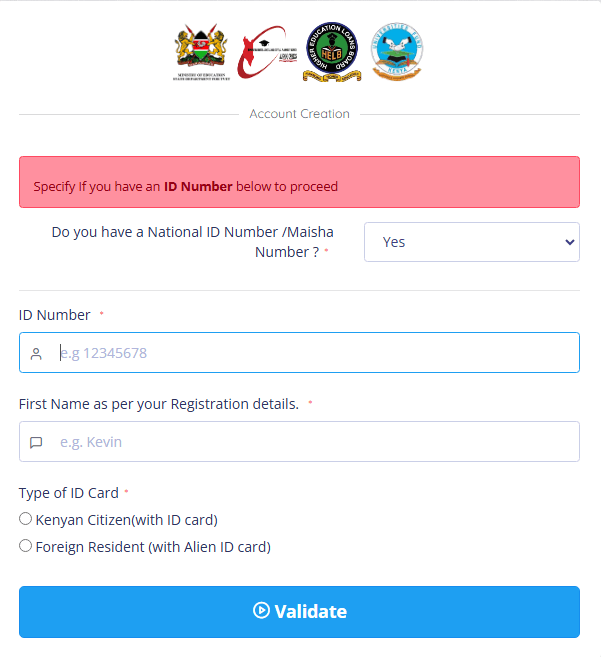

- You have two options to proceed with. The portal allows you to register whether you have an ID number or not. Click on the option that suits you best.

- If you don’t have a national ID, make sure to have your birth certificate number read with your KCSE index number, Names as they appear on the result slip, and your KCSE year.

- For those with an ID number, enter your national ID number and first name in full, then proceed to choose Validate.

- Next, proceed to enter your email and password and then click on Register

Now, when you click on Register, there is a last but crucial step. This involves verifying your account. Proceed to the email inbox or spam folder and click on the email link sent to you by HEF to activate your account. Once you do so, you can proceed to log in and access all the HEF services offered directly on your account’s dashboard.

How To Apply for HEF Loans and Scholarships

The process of applying for HEF scholarships and loans begins with registering on the platform, which we have already completed. Now, the next step is to proceed with the application; however, before doing so, you must first meet the general eligibility criteria.

Requirements

If you are applying for either undergraduate or TVET loans, the following is what you should have in advance before you proceed to apply:

- You should have registered on the HEF platform

- You should have done and sat for the KCPE and KCSE, and have your index numbers ready

- You should have the Guarantor ID numbers

- You should have an active bank account number or M-Pesa number. These will be used as a means to receive HEF money when allocated

- The following documents are also Must:

- Scanned copies of your passport photo and National ID Plus Birth cert for Minors are a must

- Scanned copies of Parents’ National ID and Death certificates, if applicable.

- A copy of the Sponsorship letters for those who were sponsored in High school

Application Process

So long as you meet the requirements that we have discussed previously, the application process will be smooth, and you can even do it yourself. Here is how to do that:

- Visit the HEF portal and log back into your account

- If it’s your first login to the account after registering, you will be immediately required to fill out your profile and update your biodata.

- Read through the consent form to understand why your data is being collected. When done, agree to the terms of use and proceed.

- Next, fill in your residence details; add your primary and secondary schools, plus the university you are currently enrolled in.

- Next, fill in your parents’ details on the completion application page. Make sure to tick the Scholarship if you are applying for it. You also have an option to select HELB loans on the same page.

- On the loan application page, accept the terms and service, update the guarantor details, and provide bank account information.s

- Before you submit, make sure that you go through all the details you have provided and that they are accurate. When you submit, you cannot edit your account profile.

What is the new HEF funding model?

After you have applied for your scholarship and loans, you might want to know how much HEF gives to applicants. While the figures vary, you should know that the ways the Higher education funding model works are mainly based on a graduated scale based on several factors assessed by MIT. Essentially, this means that students are categorized into four levels of need and awarded a corresponding amount based on their specific needs. These levels are vulnerable, extremely needy, needy, and less needy.

Through this, the Vulnerable receive significantly higher funding, with 82% allocated to scholarships and 18% to loans, while the less needy receive 38% to scholarships and 55% to loans. To help you understand, below is a table with all the percentages for all four levels:

| Student Category | Scholarships | Loans | Household Contributions | Total Funding |

|---|---|---|---|---|

| Vulnerable Students | 82% | 18% | 0% | 100% |

| Extremely Needy Students | 70% | 30% | 0% | 100% |

| Needy Students | 53% | 40% | 7% | 100% |

| Less Needy Students | 38% | 55% | 7% | 100% |

Wrapping-Up

And there you have it, friends. That’s all about HEF Loans in Kenya and the application process. Following all the information I have given you in the Guide, you can easily secure a spot at the university or college of choice with HEF Loans. Before you make your application, make sure to meet the requirements. So, I wish you all the best, but if you encounter a challenge, please let me know in the comment section, and I’ll be happy to help.