Technology has made tremendous strides in our lives, and you and I are beneficiaries in one way or another. Today, banks have embraced Internet banking solutions, making it easier to bank from anywhere in the world. When was the last time you had cash in your purse or wallet? Well, I can’t really remember. Well, with the rise of M-Pesa, various banks, including the Cooperative Bank of Kenya, have adopted M-Pesa systems with their banking infrastructure.

You can now bank at Coop Bank or Bank at M-Pesa by just using the Co-op Bank Paybill number, whether you are a new member of Co-op or just getting started with M-Pesa. I will walk you through everything that you need to know.

What is the Co-op Bank Paybill number?

The Cooperative Bank of Kenya has two official paybill numbers: 400200 and 400222. Each of these numbers is crucial, and they each serve various purposes. The first 400200 is used when you need to send money from M-Pesa to Cooperative Bank, while the second 400222 is best for business that receives bulk payment solutions through M-Pesa

Note: Using the 400200 M-Pesa Paybill charges will apply while transacting, and using 400222 is FREE of charge.

How to send money to Co-op Bank from M-Pesa?

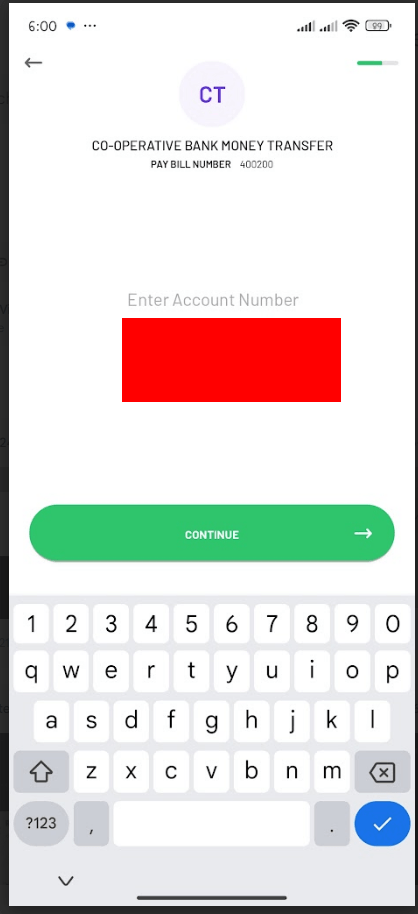

Follow the steps below to transfer money from your M-Pesa to your Co-operative Bank account:

- Open your M-Pesa app, MySafaricom app, or your SIM toolkit.

- Go to Lipa Na M-Pesa, then select the Paybill option.

- Enter M-Pesa to Co-op Bank business number, i.e., 400200.

- Enter the Co-op account number you wish to deposit the money.

- Enter the amount you want to deposit.

- Enter your M-Pesa PIN and confirm the transaction.

- You will receive an SMS confirmation message from M-Pesa & Co-operative Bank confirming the transaction.

Co-operative Bank M Collection solution

For businesses looking to save by moving Cash on M-Pesa to the Bank, using the MCollection solution Paybill number “400222” is ideal.

Businesses that receive bulk payments from their customers using M-Pesa should consider using the MCollection solution, as it offers several features such as:

- It is entirely free of charge; you will not be charged when using the service

- It is easier to reconcile your accounts because it captures customers’ details, including name and customer number

- You are notified immediately once a payment is made, and payments are reflected on your account immediately.

Businesses must first register at any cooperative bank branch in the country so that their business can use the MCollection Paybill number. To Receive payments using the paybill, the process is quite simple,. Your customers need to follow the process as follows:

- Go to Lipa Na Mpesa, PayBill option:

- Enter PayBill Number 400222.

- Enter Account No: your MCollection Business Code followed by ‘#’, e.g., 123456#

- Note: Your customer may include their name or customer number, e.g., 123456#Hse24 or 123456#Annie

- Enter the amount.

- Enter M-Pesa PIN and confirm the transaction.

- Both you and your customer will receive a confirmation SMS.

How much does it cost to send money from Coop to M-Pesa?

The cost of sending money from Co-op Bank to M-Pesa varies depending on the amount. It is as follows:

| Transaction bands (Kshs) | Transaction charges (Kshs) |

|---|---|

| 10 – 100 | Free |

| 101 – 500 | 20 |

| 501 – 2,500 | 24 |

| 2,501 – 7,500 | 28 |

| 7,501 – 20,000 | 36 |

| 20,001 – 30,000 | 40 |

| 30,001 – 70,000 | 50 |