Paypal is a well-known online payment service in Kenya. It is mainly used by the majority of the youth who work online and need it for everyday transactions. It is used not just by those working online but also by businesses and individuals like you and me. Our country ( Kenya ) has adopted technologies, and the widespread use of mobile money services has erupted different payment systems, such as M-Pesa, which gave way to the arrival of PayPal in the country.

Paypal officially entered the Kenyan market in April 2018 by partnering with Safaricom M-Pesa. However, fast forward to date. Truth be said, not all Kenyans know how to use PayPal or even open an account. If you fall into this category of people, you may be surprised that it is easier to create a PayPal account and get started than you thought. Therefore, to help make it easier for you, this article will not only show you how to register an account with Paypal but also how to link it to M-Pesa

Why Should You Open a PayPal Account in Kenya?

Paypal is an online payment service that allows registered users to easily transfer money to other users of Paypal electronically. The service was launched in 1998 but arrived in Kenya in 2018, as mentioned previously. You can easily access it using its official mobile application, which is available on Android and iOS, and through its official web interface Portal. Its Reach is not only limited to sending and receiving money, but it also has several benefits that aren’t limited to:

- Global Reach: It supports over 25 international currencies and has over 350 million users globally. In Kenya, you can use it to send or receive money without worrying

- Wide range of services: It provides services specifically tailored to personal and business needs, such as creating invoices and offering shipping solutions.

- It’s secure: PayPal has buyer protection, which helps one easily recover funds in case of fraud. In addition, your data is safe and will not be leaked during transactions.

- Integration with other services: In Kenya, you can link it with M-Pesa, enabling you to transfer funds from both platforms ( Detailed explanations below).

Requirements for having a PayPal Account

While anyone can Join PayPal, only eligible Kenyans have met its eligibility criteria. Here’s a detailed breakdown:

- Have a valid email address; it works best with Google Gmail

- A bank account, a Visa, or MasterCard ( We recommend Equity Bank Card since it supports direct withdrawals from PayPal.)

- A device that can access the internet

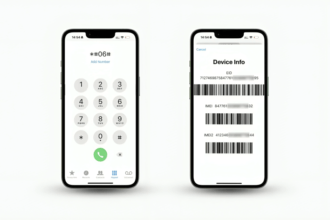

- A phone number for two-factor verification purposes

NOTE: While the above is the required criteria, it is recommended that you be over 18 and have a valid Nation dedication card.

PayPal Kenya registration

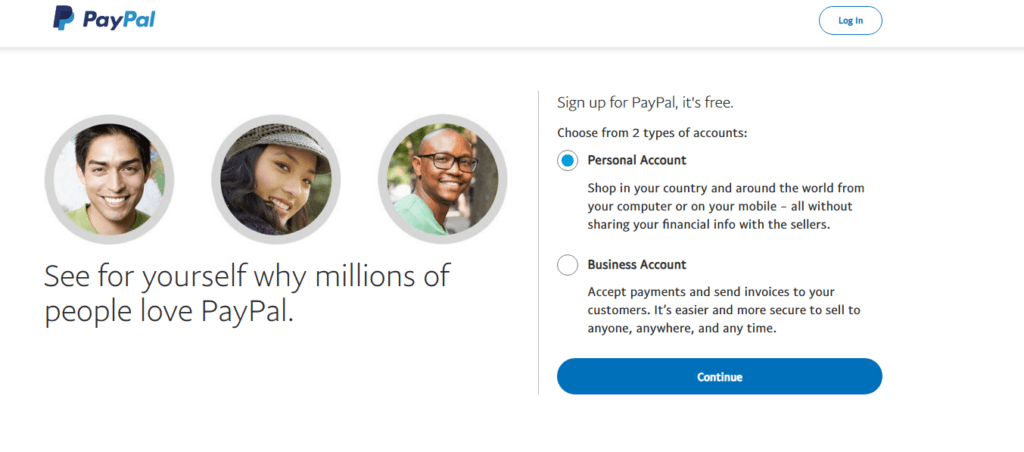

To benefit from PayPal’s offerings, you must register on the platform to send and receive money from various users. So, how do you register an account on PayPal? The process starts with visiting its website and selecting the type of account you want to register. In Kenya, PayPal offers two main types of accounts: personal and business.

There is not much difference between the two accounts; only the personal account is made for an individual who wants to send or receive cash using an online debit or credit card. In contrast, the latter (Business accounts) is for business users who sell their products and services online. Business accounts provide more features such as sending and receiving business under your name, allowing up to 200 employees to access your account, tracking payments, and getting customer support from Paypal.

So, how do you create a PayPal account? Below are the right steps to follow:

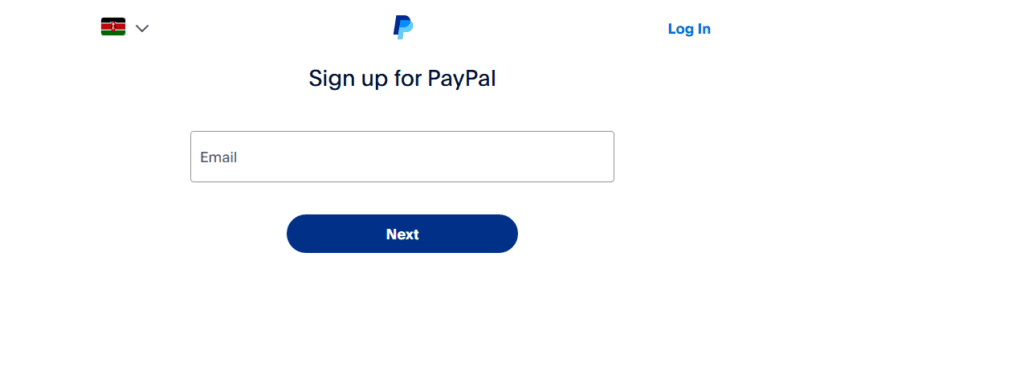

- Visit the official Paypal website using the link https://www.paypal.com/ke/home and click on Sign Up

- Proceed to choose the type of account you want to create, as discussed previously, and click on “Continue”

- Next, you must provide your valid email and phone numbers. Once you provide them, you must verify your account by inputting the SMS code sent to your phone number. Also, check your email address for an email address to confirm your account.

- Finally, create the password you will use to access your account in the future. At the same time, provide your official names as they appear on your National ID card. Accept the terms and conditions and log in to your account.

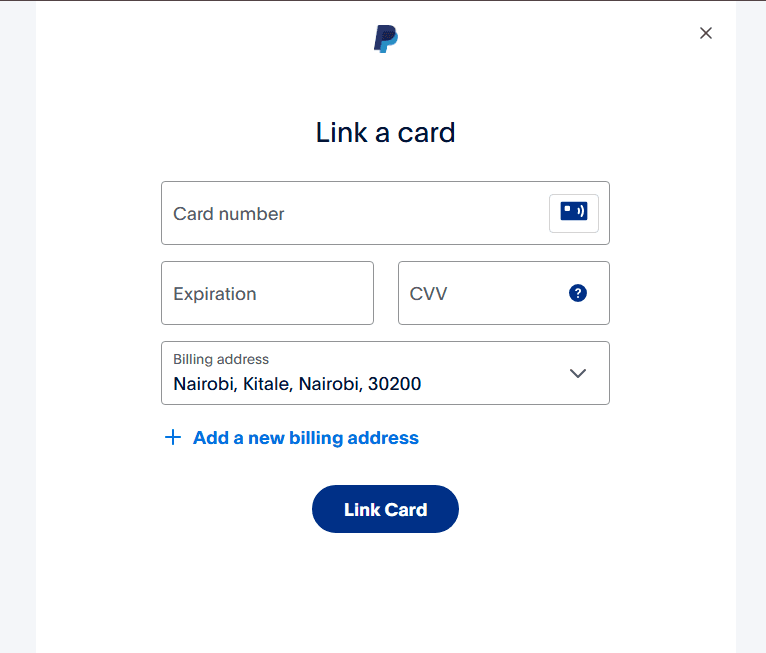

NOTE: To use your PayPal account, you must link it to your bank account or card. The process is relatively easy as long as you have completed the registration process. To link your account, sign in back to PayPal>>Select Link a Card or Bank>> Enter your card details ( Number, CVV, etc.). When you are done, PayPal will charge your Card about $1.95, which is usually refunded once the verification process is done.

How to Link Your PayPal Account to M-Pesa

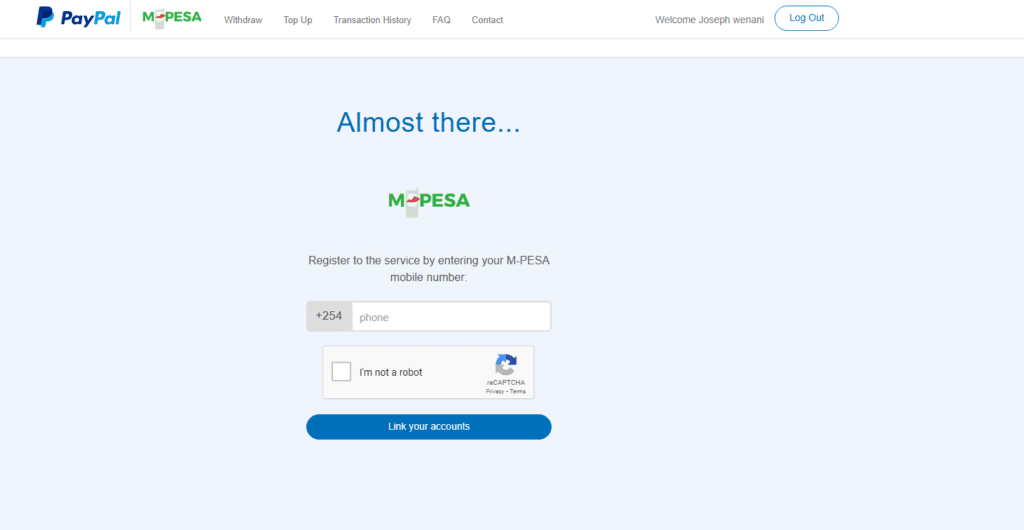

The partnership between the two companies ( Safaricom & M-Pesa) powered by Thunes has made it possible for Kenyans to use both platforms concurrently. However, the only catch is that you must first be a registered Paypal user to be able to link the two platforms.

The benefit of merging your M-Pesa number with PayPal is that you can easily transfer funds directly from your outstanding balance to PayPal and vice-versa. First, make sure that the Number you registered on your PayPal account earlier is the same number you used to link both platforms. The process involved is as follows:

- Visit the official Paypal M-pesa website at https://www.paypal-mobilemoney.com/m-pesa/

- Click on “Get started” if you don’t have a PayPal account; otherwise, proceed to log in using your PayPal credentials.

- If you click on the login Menu, a Pop window will appear with some information. Accept the terms and conditions and click on continue

- Next, you must provide your M-Pesa mobile number to connect the two accounts. Do so, click on “Link your accounts,” and make sure to verify your number using the Text Message sent as an SMS to your number

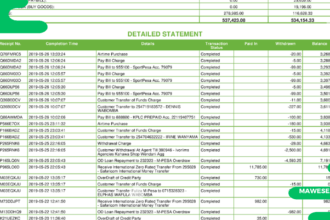

Once you have verified your number, you can Withdraw from Paypal directly or transfer money from your M-Pesa to Paypal but using PayPal Pay bill number 800088 and your phone number as the account number

FAQs

How to create a Kenyan PayPal account?

To create a Kenyan Paypal account, you need to Visit the official Paypal website at https://www.paypal.com/ke or the Paypal App to get started

Can a 15-year-old open a PayPal account?

No Paypal is only available to anyone above the age of 18 Years

Which banks are linked to PayPal in Kenya?

While at least all Kenyan banks allow access to PayPal, not all of them are eligible for all the features that PayPal has to offer. As of the writing of this article, Equity Bank is the best in Kenya in terms of withdrawals directly from a bank account. However, if you are looking to link only card, consider the following:

- Co-operative Bank

- KCB

- I&M Bank

- Stanbic Bank

Does PayPal charge a fee?

Yes, when receiving international payments, PayPal charges a fee of 4.4% of the transaction amount. When withdrawing funds from Paypal to M-Pesa, the M-Pesa charges will be applied.

Conclusion

We hope this guide has helped you easily create your first PayPal account in Kenya. Remember, having a valid account starts with meeting the requirements, selecting the account type you want to open, and verifying it. If you need to carry out any transaction with your account, you must link it to your bank or card, which we have covered in the article. If you have any questions, kindly comment below, and we will get back to you as soon as possible.