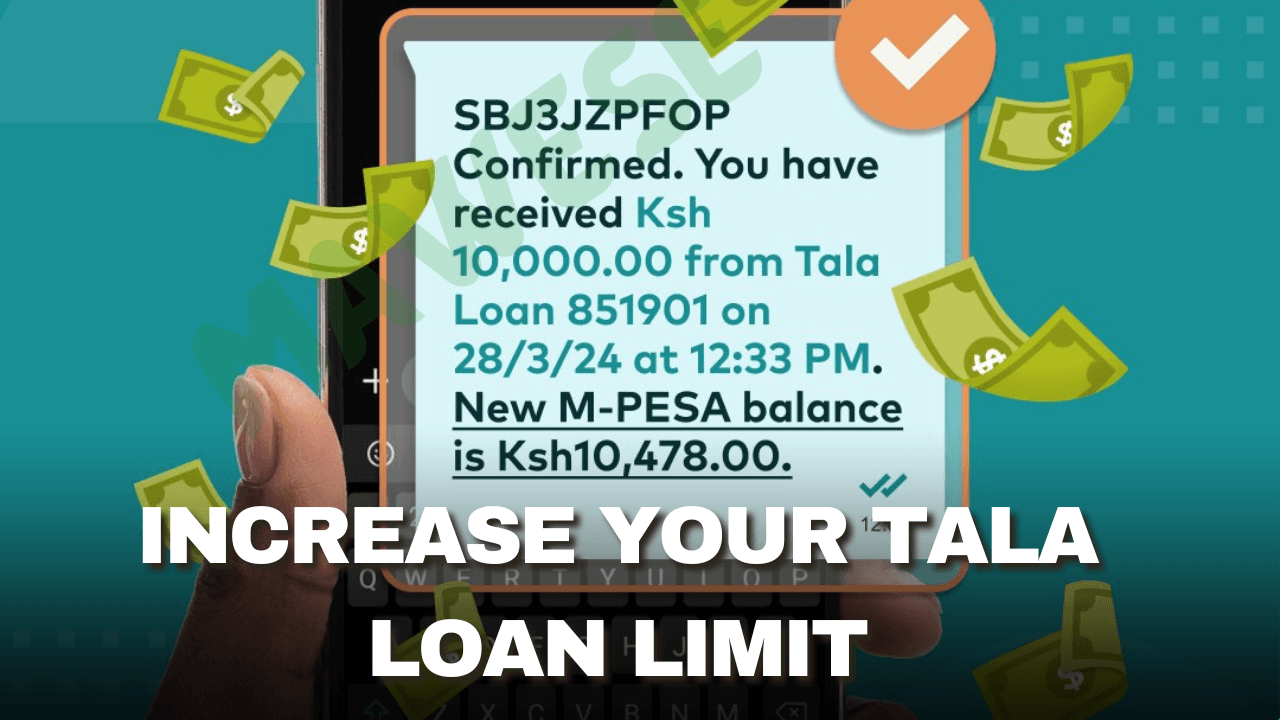

The Tala loan app is one of the many loan apps that Kenyans rely on for online borrowing. The app has been in Kenya for over eight years; it initially started as “M-Kopo Rahisi” before officially changing its name to Tala. While it is not secret that the Tala loan app still offers loans from Ksh 1,000 to Ksh 50,000, one of its consumers’ many difficulties is unlocking a higher or even the maximum limit. So, do you know how to grow your tala loan limit from as low as Ksh 1,000 to Ksh 30,000 and even higher?

The Tala loan app was launched by Shivani Siroya in 2014. It currently has headquarters in the United States and operates in Kenya, the Philippines, Mexico, and India. In Kenya, the app is known for its instant loan approval rates, but it stands out because it is licensed by the Central Bank of Kenya (CBK).

Tala Loan Limit

The Tala loan app works in Kenya because it is among the few that do not check with the CRB and can give loans of various amounts. To determine your eligibility, the loan app uses your personal phone data ( M-Pesa Transactions, the information you provide on the app, etc.) and its built-in sophisticated algorithms.

In most cases, the loan amount ranges between Ksh 1000 and Ksh 2,000 for eligible first-time applicants. The amount you are given with the second loan is now determined by your repayment history. If you make your repayments, your amount can grow to Ksh 10,000, Ksh 30,000, or even possibly the higher limit of Ksh 50,000

However, while borrowing, remember that Tala charges a daily interest rate ranging from 0.3% to 0.6% depending on the borrowed amount, with an option to repay between 15 to 61 days.

How To Increase Tala Loan Limit

According to Tala Kenya’s Official website -“Early or on-time payments are the best way to raise your loan limit. But because we consider many factors when determining your loan limit, we cannot guarantee that your loan limit will increase, or by how much.”

Therefore, if you want to grow your Tala loan limit, the secret to unlocking a higher amount is repaying your loan on time. But remember, as we mentioned previously, the loan app has sophisticated algorithms that consider several things when deciding on your loan limit. Along with early repayments, also consider the following:

- Even though Tala does not check with CRB, ensure that you don’t have a negative credit score.

- Keep Borrowing Regularly

- Keep your Tala loan app updated

- Increase your Mpesa usage activity, i.e., paying bills, using Liap Na M-Pesa, etc., since Tala checks M-Pesa transactions.

- Reach out to Tala customer support for clarifications.

FAQs

Can I loan 5k from Tala?

Yes, it is possible to get a loan of up to Ksh 5,000 from Tala. However, it is important to note that if you are a first-time borrower, the amount given will range between Ksh ( 1,000- 2,000). To achieve the 5K mark, you need to pay your loan on time and demonstrate financial responsibility.

How long does Tala take to approve a loan?

Getting from the app’s registration to applying for a loan takes less than five minutes.

Conclusion

Well, we hope this article has given you a clear idea of how the Tala Loan limit works and the processing of unlocking a higher loan amount. The key secret to growing your Talal Loan limit is making better loan repayments. If you follow the process we have guided you in the article, with time, you can see your loan growing from Ksh 1,000 to Ksh 50,000.