The Number of M-Shwari users in Kenya has been increasing daily since its initial launch in 2012 (Currently at 4.66 Million users as of 2021 ), Proving how it has rapidly become a game changer in the Kenyan financial Market. It’s a savings and loans service that all M-Pesa users can access directly from their mobile phones. Unlike traditional lenders such as Banks, the good thing with Mshawri is that you don’t need papers or even a guarantor to get a loan, proving their accessibility by millions of Kenyans. However, with the number of users climbing up, a challenge that most M-Shwari users in Kenya face is the Mshawri Limit being at Zero.

There are many reasons why you may be facing the Zero loan limit with M-Shwari, one of which is being a new user of the service along with others, as covered in the article below. The good news is that if you are in this situation or have a lower tier limit, you should know that the zero limit is not a permanent problem, as there are solutions to increase your loan limit to the maximum amount quickly. In this guide, we have covered everything that you need to know.

What Is M-Shwari and How Does It Work?

Mshawri is a product launched by the Commercial Bank of Africa (CBA) and Safaricom through M-Pesa. It is a Loan and savings account at the same time because the CBA issues savings accounts and loans by accessing risks and Nonperforming loans (NPLs) while M-Pesa provides its broader reach to millions of users active on the platform.

By the way, it is safe to say that M-Shwari is a bank on its own since it is subject to all the banking regulations in the country. All active accounts created on the M-Pesa platform sit on CBA’s financial statement and are tracked in

a dedicated banking system linked to Safaricom’s data and the bank’s core banking system.

M-Shwari Limit

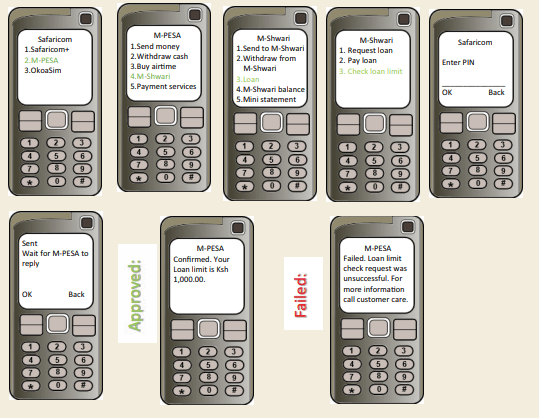

To know your M-Shwari limit, you must be registered on the platform. The joining process is easy and is done via M-Pesa Menu>>My Account>> M-Shwari. Also, you must have deposited at least Ksh 1 to access your limit; the process of checking your account limit is as described in the figure below:

As of 2025, the minimum M-Shwari limit is Ksh 100, while the Maximum is Ksh 50,000. Now, here is the catch: this is only available to those who are qualified for some; you may be surprised to see your Limit at zero (0). There are quite many reasons why this might happen to you. The primary reason is that you are new to using M-Pesa, and your M-Shwari account is also new.

Another common reason is if you have a poor credit score listing. This should not be ignored since M-Shwari checks if a lender is listed on various CRBs before you are assigned a loan amount. To ensure you qualify for a time loan from M-Shwari, demonstrate creditworthiness through deposit behavior, transact on M-PESA for at least six months, and have no outstanding loans with other lenders.

How to Increase Your Zero M-Shwari Limit

Before we discuss how to get a higher loan limit, you should know that the M-Shawri loan limit review cycle lasts 30 to 90 days. This means that M-Shawri will occasionally review your account during these periods to determine your next limit. Below are the steps to increase your limit for those with a lower loan or even Zero.

1. Save with M-Shwari

By now, it is clear that M-Shwari is a loan service and a Savings account. The minimum amount needed to open an M-Shwari savings account is Ksh 500, and you can save any amount from 1 to 6 months. Your savings earn an interest rate of up to 6% per annum for locked savings accounts. In return, the more you keep using M-Shwari for savings, the higher the chance of unlocking a higher loan limit.

2. Keep Using M-Pesa Constantly

M-Shwari is built on top of M-Pesa, which means for every active account, the service also has your data on M-Pesa, which it uses to determine your loan limit. So, don’t focus on what Mshawri offers to get a high loan limit; also, try to use other M-Pesa services such as Lipa Na M-Pesa, buy airtime, and more. The more you use M-Pesa, the more a positive signal there is a possibility of a higher limit.

3. Make early M- Shawri Repayments

For every loan you are given on M-Shwari, you must commit to paying the loan back, hence the chances of being listed on CRB, which will also impact your credit score negatively. Generally, the M-Shwari loan is to be repaid within 30 days from the day you know, but early repayments are permitted.

If the loan is not repaid by day 31, it is automatically renewed for an additional month. You will receive a text informing you that a 7.5 percent facilitation fee has been charged (on the outstanding balance), and the loan is now due on day 60.

If you do not repay the loan by day 62, any amount in your M-Shwari account will be taken to repay the loan. If you do not have the expected amount on day 90, you will receive a final reminder, and 30 days after this (120 days in total), your details will be forwarded to CRB. So, to avoid all this, pay your loan on time, and further, if you make early repayments, this signifies good financial behavior and the cancer of an even higher loan limit.

4. Keep Borrowing

Even after making repayments of previous loans and requesting another loan. For every loan requested, both the M-Pesa & CBA record your financial data, and every time, your data will be used to calculate your following loan limits.

5. Avoid defaulting to CRB from any lender

One of the mechanisms that M-Shwari uses to calculate if you are eligible for a financial loan is by checking your records on CRB. In Kenya there are so many loan apps that offers loans some check with CRB & Some don’t. Therefore, before you use, M-Shwari, ensure that you have not been defaulted by any lender and, simultaneously, your credit score is on the check.

FAQs

What is the maximum amount you can save on Mshwari?

With the standard savings account, you can save up to Ksh 100,000. This only applies to those using Know Your Customer (KYC) verification. However, the limit can grow to Ksh 250,000 if your national ID is verified and up to Ksh 500,000 if you Physically submit your ID at any Safaricom Shop.

There is no minimum savings requirement for those using locks and savings accounts. You can save any amount and earn interest of 3 to 6% per annum, depending on the amount saved.

Why is the M-Shwari limit zero?

If you are new to M-Pesa and do not meet its eligibility requirements, your limit will likely be zero. For continuing users, your limit will be canceled to zero if you fail to repay your loan after 120 days.

And there you have it. Increasing and growing your limit from Zero to Ksh 50,000 is possible. All you need is to to demonstrate responsible financial behavior and follow the five steps outlined in the article.